What is Martingale technique in Forex?

The Martingale system of trading is one of the most common trading techniques, which is followed by forex traders from diverse backgrounds and industries. In fact, a good number of traders have found the martingale strategy to be highly attractive and useful in terms of doubling profits. The system essentially provides traders with predictable results as far as profits is concerned and does not require them to identify or make predictions about the market direction or conditions. In this article, you’ll discover what martingale system is all about and its relevance for forex traders.

The Martingale System

This system is designed around the extremely popular system of gambling or betting, which was basically practiced in France during the 18th century. According to the martingale trading strategy, traders must double their bets every time they lose. As a result, when the trader eventually wins (given a 100% bet loss/win every time) he/she recovers the amount lost previously and thus makes higher profits.

This strategy is excellent for traders who have a lot of money at their disposal. However, not every trader has that huge amount of money with them and may therefore end up losing all their savings. Thus, traders need to understand that the Martingale system does not enhance their chances of winning. In fact, their expected long-term returns will continue to be same with every bet. Traders who’re capable of placing winning/successful trades and the right trading decision are the ones who can benefit through this particular strategy.

Does the System Really Work?

As far as the Martingale trading system is concerned, even if the prices go against the expectations of the traders, they simply need to double their trades. However, this system cannot exist in reality as it requires traders to have endless supply of money as well as time. In reality, traders need to fix their drawdown limit and once this is exceeded, the trades are closed with a loss and the trade cycle is started all over again. As a result, when a trader places more number of trades, they’re likely to increase their chances of losses and may eventually end up wiping their accounts.

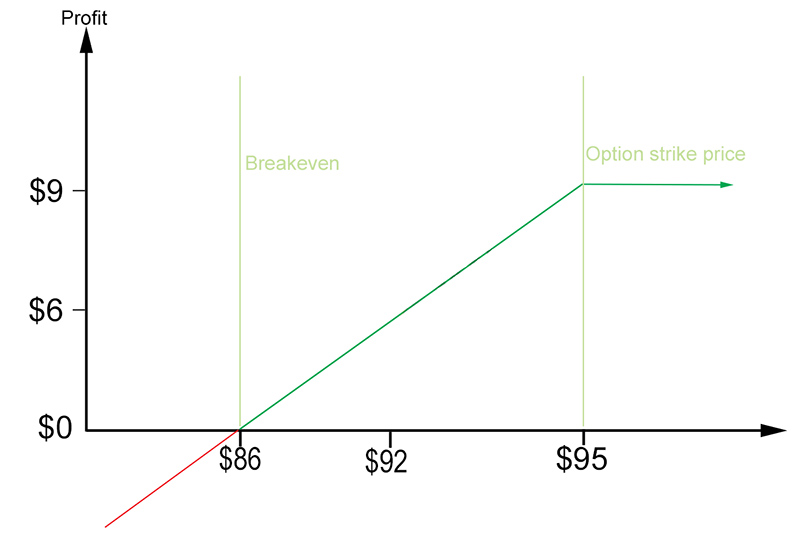

Under the Martingale strategy forex traders end up exposing their trades to a large extent and when they’re forced to leave the market early, their losses are way more than what they may have initially assumed or expected. Thus, their profits from winning/successful trades increase only linearly. In fact, it is proportional to almost half the profit for every trade when multiplied with all the trades in totality. On the other hand, a successful trade always results in profit under the Martingale strategy. In a nutshell, this system does not improve your odds of winning and the net return continues to remain zero. This is precisely why many traders tend to use the Martingale strategy in reverse. This system works in exactly the opposite direction. It helps a trader in doubling his/her wins and cutting the losses quickly.

Using the Martingale System for Yield Enhancing

Traders who’re looking to earn profits through the Martingale system can use it for yield enhancing. Hence, traders can opt for currency pairs that trade in tight trading ranges. Besides, traders must also understand that the Martingale system is capable of surviving trends only where there’s enough pullback. That’s precisely why they need to keep a track of the significant trends, especially when the prices are around the key resistance and support levels. Traders who choose to trade pairs that trend strongly such as the Yen or even commodities can end up risking their profits.

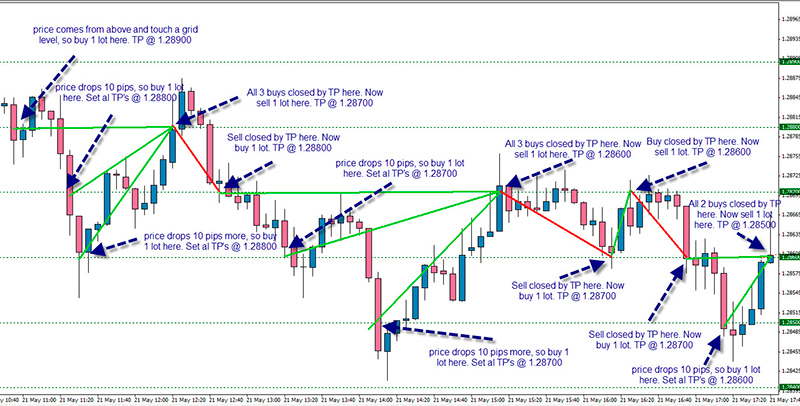

Trading With the Martingale System

When it comes to using the Martingale system for trading, traders must understand that they can opt for almost any pair of currencies as well as timeframe. However, it’s important that they first determine their size when it comes to taking a position. It’s also impertinent for traders to place their sell or buy orders in any direction. As a result, they’ll either lose or win the trade, depending upon their predictions. In case they end up wining they can set their position size and place either a stop loss or take profit order. However, if they end up losing, traders can double their position and place an order accordingly.

The Moving Average Line and Martingale Technique

Apart from using a forex calculator and the above mentioned techniques, forex traders can also rely on the moving average line when using the Martingale system for entering a trade. However, it is advisable that they trade close to the key resistance and support levels as well as when the markets are less volatile.

Setting the Stop Loss and Take Profit Orders

Traders must also know when to stop loss and take profits in a trade when using the Martingale system. As a result, if they feel that the market has moved against their expectations and they may encounter a loss, they must double their lots. Traders must also understand that choosing a small value will cause them to open several trades, whereas choosing a bigger value will impede their entire trading strategy. Thus, the value that they select for their stop loss as well as take profits must be in accordance with their trading time frame and market volatility. Typically, any value between twenty and seventy is usually good for traders.

Additionally, when using the Martingale system, traders must close their trades only when they’re in a profitable position. The Martingale technique requires traders to remain consistent with their trading activities and take all their trades into consideration instead of concentrating on them independently. Hence, a smaller value of take profit, which is typically in the range of 10 to 50 pips, is best for traders. This is because a small take profit value will increase your probability of closing the trade when the system is yielding profits. Apart from this, the profits are compounded as the lots that are traded rise exponentially. Traders who opt for a small value of take profits may incur lower gains but end up improving their overall winning ratio.

Final Note

To sum up, the Martingale system has its own pros and cons. While, it lays down definite trading strategies and rules, it produces statistical outcomes with regard to drawdowns and profits. In fact, if used appropriately, the system is capable of providing incremental profits. In addition to this, the technique also does not require a trader to keep a track of the market course or direction. However, there is the other side of the coin too. The Martingale system enhances your risks and essentially depends on assumptions about market direction and behavior, which may not be always true.