How to Set Stop Loss and Take Profit Using the Right Strategy?

Traders, specifically those who’re new to forex trading often worry about identifying the ideal trading strategies that can further help them in placing successful or winning trades. As a result, most of them are always concerned about placing stop loss orders as well as taking profits in a trade. However, traders need to understand that they cannot achieve profitable results in the absence of an appropriate trade management strategy. Thus, they need to focus on improvising their risk/reward ratio. This in turn requires them to have deeper understanding of the stop loss and take profit ratios and levels. Here, discover how to set stop loss and take profit using the most appropriate method or strategy.

Stop Loss and Take Profit Explained

Stop loss (SL) as well as Take profit (TP) management is a prominent concept of forex trading. It requires traders to gain deep knowledge and insight into the principles of forex trading. While, Stop loss is basically an order that traders send across to their brokers stating them to limit their losses in a specific position, Take Profits lets them lock their profits once the asset has reached a specified pricing level. Hence, the Stop Loss and Take Profit strategy is used for exiting the market at the right time and in the right manner.

Identifying the Level of Stop Loss

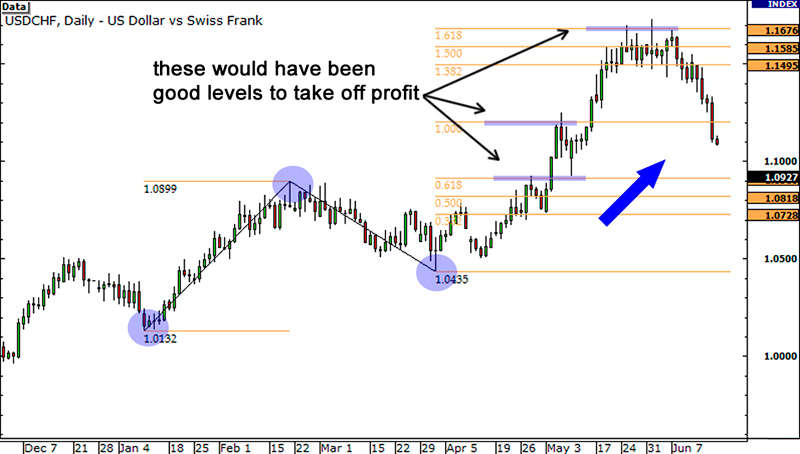

Support/Resistance levels are essentially those areas that are highly volatile simply because multiple orders are being transacted at those levels and hence they do not always move exactly as per the technical analysis as well as the general assumptions of the traders. However, traders who have a better understanding of the manner in which these levels work can place their stop loss orders and earn attractive profits by assessing the support as well as resistance levels. Depending upon the market forecast and direction, traders can either choose to place their stop right above the main swing high for short term trades and below the main swing low for long term trades. This allows the market to make appropriate adjustments, which further leads to a trend reversal.

Identifying the Level of Take Profit

When it comes to trading in the Indian stock market, traders also need to set a Take Profit or target level. However, instead of picking any random target, traders must carefully assess the market to determine their Take Profit level.

Stop Loss Order Opening

Stop Loss order opening allows the traders to assess the actual amount that they are ready to put at risk for each and every deal. As a result, traders need to master the art of stopping the losses just at the right time. Professional forex traders firmly believe that it’s best to adjust the stop loss in accordance with the market directions or conditions. Apart from this, traders must also be willing to conduct a thorough technical analysis in order to take a practical decision. In fact, most of the forex traders emphasize on knowing the right time for exiting a trade, as it allows them in placing winning or successful trades.

Methods for Determining Stop Loss

Traders can use three different methods for identifying the most appropriate stop loss levels:

Percentage Method

Forex traders can assess the stop loss levels on the basis of the capital amount that they’re ready to risk at every single point. In such a case, the stop loss level will entirely depend on the total amount of capital as well as the money they’ve invested. According to trade analysts and experts, traders shouldn’t allocate anything in excess of two percent of the capital amount to one particular deal.

Chart Method

This particular method is entirely technical as it involves assessing of support/resistance levels for determining the most appropriate Stop Loss and Take Profit levels. Traders can thus set stop loss ahead of the support and resistance levels. As a result, when the trade moves past these levels and the market trend does not work in the trader’s favor, then the traders can take whatever remains of their investment.

Volatility Method

Traders never want to skip volatility. However, it always differs from one asset to another, which further impacts the trading outcomes in a major way. Hence, if traders are aware of the extent or levels to which the forex pair or an asset would move, then they can easily determine the most appropriate stop loss levels. Also, assets that are volatile in nature may need high risk tolerance and thus higher stop loss levels.

As far as forex trading is concerned, traders can design their very own Stop Loss and Take Profit systems using multiple approaches. However, their Stop Loss and Take Profit systems must be based around their trading strategies as well as the conditions of the market.

Determining Take Profit

Take Profit orders allow traders to acquire their money once the deal reaches its peak position. It is impertinent for traders to take profit at the right time as the market is always fluctuating and can experience a downturn in just a couple of seconds. Some traders believe in taking a decent or lower profit instead of risking their entire money. However, they must understand that this strategy isn’t appropriate either, as it does not allow them to earn huge profits. Thus, when it comes to taking profits, traders must carefully choose the most appropriate moment as well as close their deals ahead of a trend reversal. Therefore, traders can use technical tools such as Relative Strength Index and Bollinger Bands, for assessing the right take profit levels. Some traders recommend the 1:2 risk and reward ratio. Given such a scenario, even when the loss is equivalent to the successful trade figures, traders will still end up incurring profits. Traders must therefore find an appropriate risk as well as reward level or ratio, which also meets their personal trading strategy. They must also understand that there is no specific rule that works for every single asset or trader.

Final Words

In order to set the appropriate stop loss and take profit levels, traders must steer clear of automated trading systems. Instead, they should use these systems to gain more control over their deals as well as emotions. Also, mastering the art of placing stop loss and take profit orders requires traders to gain adequate knowledge, experience and understanding of the forex market and trading conditions. Traders must carefully weigh their risks as well as rewards from their deals and later decide whether it is worth their time and money or not. Besides, forex traders should be primarily concerned about preserving their capital amount. In fact, traders should never use their capital amount until they’re completely sure about winning the deal.