BTCUSD Weekly Outlook and Bitcoin Fundamentals , July 29 2020

BTCUSD Forecast and Technical Analysis & Fundamentals for Bitcoin

Introduction

Amid the first wave of COVID-19, we could see how it affected businesses and the world economy. The sudden rise of the second wave can force another shutdown of business if proper measures are not in place.

Let us look at the chart and see how the IQ Option traders will trade the bitcoin in the coming days?

BTCUSD: Technical Analysis

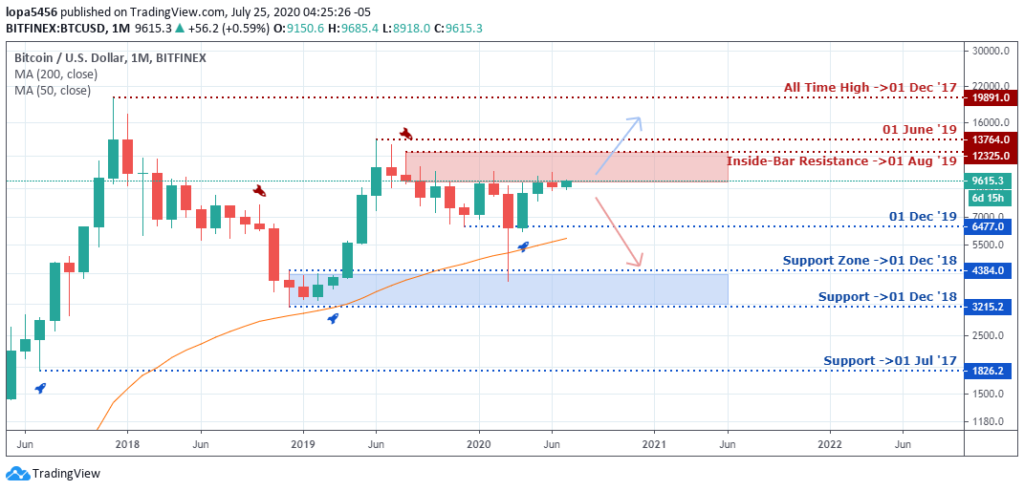

Monthly Chart

Monthly Resistance Levels: 12325.0, 13764.0, 19891.0

Monthly Support Levels: 1826.2, 4384.0, 3215.2, 6477.0

The 50 moving average is acting as dynamic support for BTCUSD on the monthly chart you can see the support levels of 43840.0 and 3215.2 which were on 01 December 2018 that gave the Bulls the push to the upside.

If the Bulls can close above the 12325.0 and 13764.0 resistance levels, we expect the next rally of the Bulls to be exposed to the all-time high of 01 December 2017.

The Resistance zones have been tough for the bulls following a rejection of the previous swing high. For the Indian broker, the uncertainty of the global economy is still hovering in the air since the COVID-19 second wave could affect the recovery process of the world’s economy.

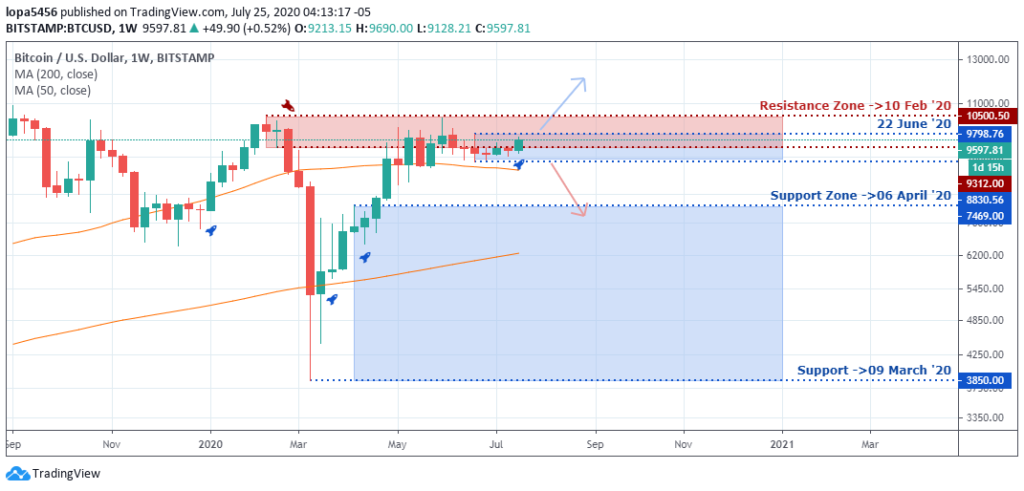

Weekly Chart

Weekly Resistance Levels: 13000, 11000, 10500.50

Weekly Support Level: 8830.56

The bitcoin price has been hovering between 9967.81 and 97589.76 for the past four weeks since the bitcoin price entered into range after hitting the weekly chart’s major resistance zone at 10500.50 price zone.

The bullish trend that started from the support zone of 09 March 2020 took the price up from 3520.00 to the high of 10500.00 before it lost its momentum. The Bulls were able to recover the distance they lost to the bears some weeks ago. For the bullish trend to continue, we need to see the bullish candles closes above the resistance zone of 10.500.50.

From the resistance zone of 10 February 2020, the Bears may come into the BTCUSD market and turn the table because they have done so before. If the region is respected, we shall see another sharp rejection of the price from that area in the coming weeks.

Daily Chart

Daily Resistance Levels: 10428.00, 10018.67, 9792.00

Daily Support Levels: 7390.00, 8106.70, 8533.98, 8970.00, 9182.66

The Bulls’ resilience against the Bears pressure was successfully repelled from the support zones that had been tested severally.

The bullish surged on the daily time frame shows that a bullish momentum on the time frame from the support zones of 9182.66 and 8970.00 of 11th and 4th May 2020 respectively had long position contracts placed by buyers for the price to swing higher in the nearest future.

For the buyers to have a strong buy position in the market, they need to push the bitcoin price above the resistance zones of 9792.00, 10018.67, and 10428.00 for a sizeable profit.

The fight won’t be an easy battle for the buyers without the sellers putting a stiff resistance at the zones of where they dominated the market before.

We’ll have a clearer picture of events to know if the Bears will regain control of price in the coming days.

BTCUSD H4 Chart

H4 Resistance Levels: 9798.76, 9479.57

H4 Support Levels: 8830.63, 8900.00, 9025.75, 9125.21

The H4 shows a bullish swing at the time of this report. You can see the bulls breaking above the previous resistance zones and turning it to support.

From the recent support of 9479.57, the next surge of the bulls is to close above the 9798.76 resistance zone of 22 June 2020 for another upward trend.

However, the 9479.57 zone is a psychological level for the Indian brokers. The sellers were able to push the bulls back to support levels8900.00 and 8830.63 of June 14th and 27th. We may look at the possibility of another rejection of price at that zone.

As events unfold, let us observe bitcoin’s reaction as it retests that level again to know if the price will be rejected or not.

Bullish Scenario:

The bullish scenario at play on the time H4 and the daily frame is an early indication of the Bulls’ strength in the coming days, and if it is sustained, we may see it last till the end of the month. We expect the bullish trend to reach the 10018.67 level in the coming days.

Bearish Scenario:

The bears are currently weak on the H4 and daily time because there was bullish strength of those time frames as at the time of this report.

From the weekly time frame, the resistance zone of the 10500.00 is a psychology level for the bears, and they hope to turn the bitcoin price from that zone should they succeed in taking over the bulls’ momentum in the coming days and weeks.

Bitcoin BTC News Events

Can higher education be disrupted by the blockchain effects?

During the COVID-19 crisis, a lot changed in the educational sector, health sectors, jobs, and other sectors. However, the United States of America Department of Education supported the notion of blockchain in higher education.

Some look at the advantage of the blockchain as a means to have a good store rage devise that individuals or institutions can access.

Some school of thought looks at the disadvantage of this centralized data because the consent of the individual may not be considered before the persons’ data is used or changed.

According to Kim Hamilton Duffy (Digital Credentials Consortium), he believes that the COVID-19 pandemic will accelerate the demands for digital credentials in a few years.

The system sees that anyone can be an issuer in an open infrastructure corporation making peer to peer competency credentials possible among students, clients, employers, and other institutions.

Conclusion and Projection

The BTCUSD price has been in a range for the past weeks within the high of 9798.76 and the low of 9597.81, as both buyers and sellers have a good share of the market.

However, the bears have a dominant force in the market on the daily time frame before the bullish momentum that broke the trend line, the breakout if not enough to confirm the bull’s takeover because it may be a false breakout.

The Indian brokers and other traders should get another confirmation before going long.

No Comments found