EURUSD – Weekly Outlook for 26th November 2020

EUR to USD Forecast for Forex in India

Introduction

EURUSD Traders and investors across online trading platforms, such as OlympTrade, are waiting for information on the distribution of the virus vaccine by W.H.O. (World Health Organization), considering the benefits it brings to the society at large and how it will affect the financial market.

Fundamentals

Euro Zone French Flash service PMI

Forecast 39.2 while previous is 46.5

The number of infected persons in the Eurozone is increasing, which led to the introduction of the new lockdown measures. It will affect the various businesses within the zones.

A survey was carried out on the purchasing managers to know the industry’s level of diffusion index. Over 700 managers were asked about the relative level of the various conditions affecting businesses’ services regarding supplier deliveries, inventories, order, price, and employment, among others.

Data that is above the forecast is useful, but a lower report is not suitable for the currency.

U.S. Unemployment Claims. Forecast 732K previous 742K

The department of labor releases the jobless claims report every week regarding individuals who filed in for unemployment during the week for the first time.

When the released data is higher than the forecast, it is not suitable for the currency, but it is ideal for the U.S. dollar lower than the estimates.

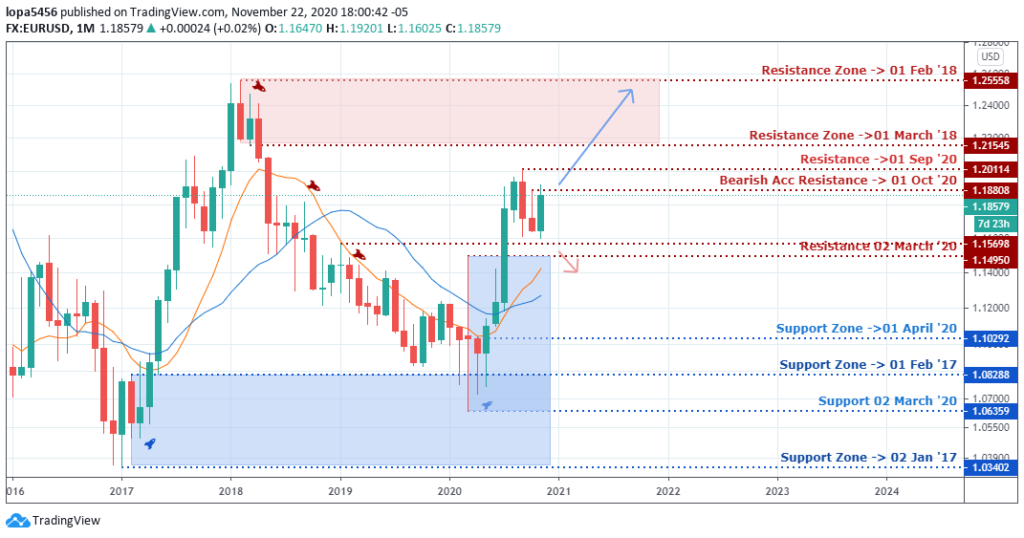

EURUSD Technical Analysis

E.U.R. vs. USD Bigger Picture: Upward Trend

Monthly

Monthly Resistance: 1.15698, 1.18808, 1.120114

Monthly Support: 1.10292

The pair has been bullish right from the support level of 1.10292 April 2020 during the hit of the covid-19 pandemic that weakens the U.S. dollar. Looking at the trading platform, we expect the monthly bar to surge and finally close beyond the 1.18808 resistance level for the uptrend to continue.

There are possibilities that the EUR/USD pair may find it challenging to close above those zones, and the bears may have control of the market from that level. A close below 1.15698 will expose the low of 1.10292.

Weekly Chart Bullish

Weekly Resistance: 1.19207, 1.20114

Weekly Support: 1.16124, 1.12430

The resistance zone EUR/USD pair has been a barrier to the buyers in the market for some periods, having rejected the Bulls’ advancement around the area. A price close above 1.19207 level should see the trend continue in an upward direction.

However, a bearish momentum from the resistance zone may drive the price lower and below the support level of 1.16124, which will turn the trend into a downtrend. The recent lockdown happening in some parts of the Euro will likely weaken the strength of the currency.

EURUSD Mid-Term Projections: Bullish Consolidating

Daily

EURUSD Daily Resistance: 1.20500

Daily Support: 1.17712

The E.U.R. resumed strength against the Greenback after the news release of the virus vaccine by Pfizer.

Our forex platform shows the daily chart has recently been range-bound. The pair has been moving within the support level of 1.16122 and the resistance level of 1.19163 for days.

The market needs a well-defined direction for investors, institutions, and traders to open their various positions.

A second wave of the covid-19 could be a significant factor because the number of new cases been recorded is a threat to businesses.

H4

H4 Resistance: 1.1900

H4 Support: 1.16016

The H4 time frame shows signs of the bearish trend as the 1.1900 level rejected the bullish run more than twice as the price drops from the level. If the resistance should give way to the buyers, we shall see a bullish rally to the upside.

We may also see the short position opened for the price to go lower towards the support of 1.16016 as the stochastic signal line indicates an overbought indication.

Bearish Scenario:

Although the higher weekly time frame shows a strong bullish sentiment, the lower four-hour time frame hints a short term bearish outlook with a reversal chart pattern around the 1.1900 zones.

Bullish Scenario:

A general bullish scenario is possible based on the weekly time frame if the price finds a close over the 1.19207.

Conclusion and Weekly Price Objectives

The covid-9 virus’s resurgent will likely affect personal spending and consumers’ confidence during the holiday shopping season (Black Friday).

The French business activities are low because of the second waves of the covid-9 and their effects as the government imposed tight covid-19 restrictions.

No Comments found