EURUSD – Weekly Outlook for 5th February 2021

EUR to USD Forecast for Forex

Introduction

The US and UK economies recently show strength against the Euro on India forex trading platforms, following positive sentiments towards the expected US stimulus package and the UK’s lead at delivering the COVID-19 vaccines.

Read on for more on the events and chart patterns moving the EURUSD exchange rate.

EURO and US News

An increase in optimism over economic recovery from more US stimulus saw a rise in global stock markets for two days in a row.

Meanwhile, retail investors withdrew their positions from GameStop and silver, consequently leading to a slump in their prices.

GameStop’s share price, inspired by the now-famous WallStreetBets subReddit and surged for about 5X in 5days, now sees a sudden 55.9% slump in its price to somewhere around 99.11USD.

Following a surge to the 483USD mark, GameStop closed at 325USD per share on Friday.

After a massive buzz of a possible short squeeze on silver, the commodity slumped by -7.61% to trade at 26.77USD, following a raise of maintenance margin by the CME Group operator on the COMEX 500 silver Futures.

According to Tom Hayes of Great Hill Capital LLC, a hedge fund in New York, the CME intervention on silver snuffed the air out GameStop, as short interest dropped to about 53% from 140%.

Investors’ positive outlook on President Joe Bidens’ $1.9trillion COVID-19 relief package proposal upon meeting with ten Republican senators led to a surge in the equity markets.

The DJI Dow Jones Industrial Average gained 1.96%, while the SPX S&P 500 and IXIC Nasdaq Composite gained 1.80% and 1.84%, respectively.

AMZN Amazon and GOOG Google gained 2.19% and 1.96% during the day.

The Pan-European STOXX 600 closed at 1.29%, following overnight positive momentum that flowed from Asia into Europe.

Coloplast COLO_B, the makers of medical devices, and INDT Indutrade of Sweden were top gainers on STOXX 600, hitting quarterly earnings.

The USD attained a two-month high against the EUR based on a gauged difference in strength between the European and US economic recovery from the COVID-19 pandemic.

Primary government bonds in the Eurozone lean to the upside as global market sentiment maintain a bullish outlook on the proposed US stimulus.

The GCv1 US gold futures lost 1.6% to trade at 1834.90USD, while oil price added a little above 2% to the respective highest levels since twelve months.

The CL1! US crude futures and BRN1! Brent crude rose by 1.21USD and 1.11USD, respectively.

EURUSD Technical Analysis

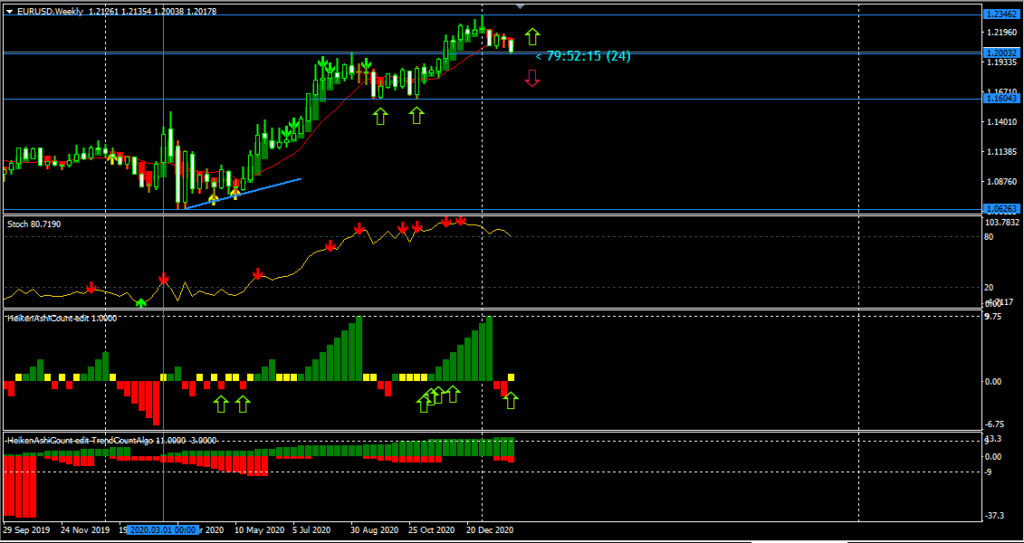

Weekly Chart Bullish and slowing

Weekly Resistance Level: 1.23462

Weekly Support Level: 1.16770, 1.13970, 1.06263

The Heiken Ashi count indicator signals a bullish eleven count and confirms the current phase of the weekly EURUSD outlook as a correction phase.

A deep bearish closing candlestick is likely for the week, suitable for an upward price rebound next week.

Daily Chart Projections: Bearish

Traders holding short-sell positions on the EURUSD are advised to tread with caution as the selling pressure on the daily time frame may lose steam if the bulls can exit the level-20 oversold area.

H4 Intraday Chart Overview

Rounding up on the H4 time frame, the EURUSD forms a bearish fold-rule chart structure that highlights a steep downtrend and a continuation of the bearish trend.

A breach of the more current bearish trend line should hint at a drop in demand for the US Dollar and a possible rise in the EURUSD exchange rate.

EURUSD Conclusion and Weekly Price Objectives

Wednesday’s ISM data release highlights a rise in the US service industries’ activity, reaching almost a two-year high in January gave a boost to the USD.

More liquidation of USD shorts should increase demand for the USD and a decline for the EURUSD exchange rate.

A price close above the October ’20 resistance 1.18808 confirms sound support at the 1.16121 price point.

If the current bearish momentum creeps below the support, we may see further demand for the Greenback and a weaker Euro.

No Comments found