EURUSD – Weekly Outlook for 15th January 2021

EUR to USD Forecast for Forex in India

EURUSD Introduction

Speculations on fiscal stimulus by President-elect Joe Biden bumped up the US Gov bonds and consequently holding the Greenback above three-year lows.

An increase in ten-year Treasury yield was witnessed following a CNN report of the stimulus estimated at two trillion USD, buffering the USD on OlympTrade trading platform.

EURO and US News

This week, a sharp 0.18% move in US Stock futures ES1 is registered, as US Treasuries also push further their rallies to the highest level in roughly a year, leading to a slight flattened yield curve.

The British FTSE futures FFic1 gained 0.18%, recording strength against European trade, as the Euro Stoxx 50 futures STXEc1 dropped by 0.03%.

The FDXc1 German DAX futures increased by 0.03%.

Massive selling of US Treasuries boosted demand for the dollar as global markets stay positive towards a calm countdown to president-elect Joe Biden’s inauguration in the coming week.

European shares’ trading is currently unclear as a lack of corporate news shows a vague market direction.

Head of currency strategies at TD Securities in Europe, Ned Rumpeltin, says the market shows mixed signals with a degree of uncertainty, with a stable gold vs. USD and stocks staying on the highs. He went on to highlight that the US still witness a tense political atmosphere.

US Democrats now offer President Donald Trump the last chance to leave the White House and the office a few days before his tenure expires, or risk being impeached over a breach of the US Capitol by his supporters.

Speculation around more government stimulus under president-elect Joe Biden as he takes charge of the White House next week ignites the selloff of US bonds.

Further bets on a hike in interest rates by the Feds lead to a surge in US yields before a slowing of asset purchases and bringing increased interest to Fed Chairman Jerome Powell’s speech this Thursday at Princeton University (1730 GMT).

Investors will be expecting earnings release by Citi, JPMorgan, and Wells Fargo on Friday.

Andrews Bailey, the Bank of England Governor, says that a resurgence in COVID-19 cases would lead to difficult times in about a couple of months ahead.

The London UK100 shares dropped by 0.7%, while the PX1 of Paris and DB1 of Frankfurt stay steady.

EURUSD: Technical Analysis

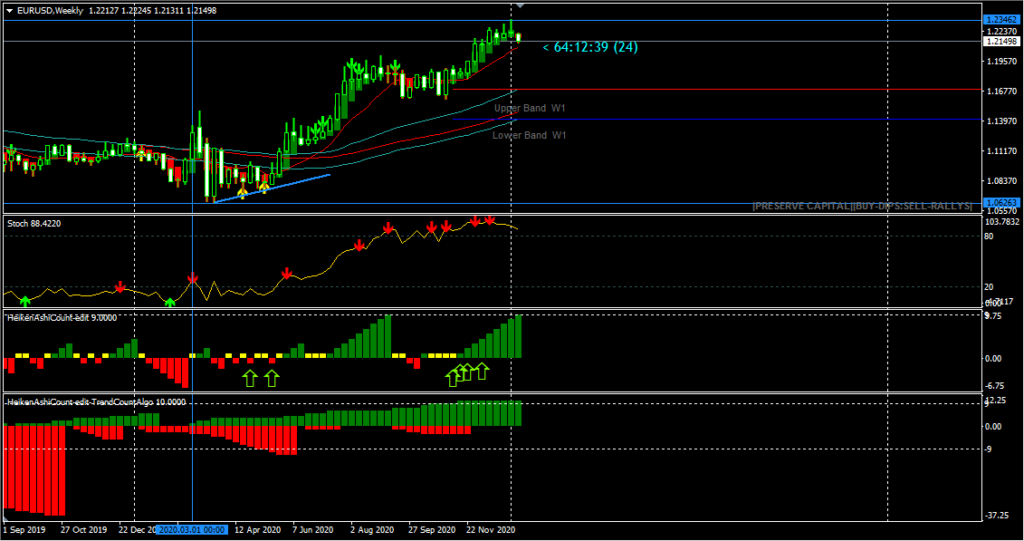

Weekly Chart Bullish and slowing

Weekly Resistance Level: 1.23462

Weekly Support Level: 1.16770, 1.13970, 1.06263

The indicators attached to the EURUSD weekly time frame subwindow maintain a stable bullish trend, offering incremental levels to scale into the rising EURUSD trend.

Starting with the trend following stochastic oscillator, the downward-pointing red arrows show levels where the EURUSD starts to correct and as it soared out of the Level-20 oversold area.

Similarly, the HeikenAshi count oscillator also confirms the uptrend is forming consecutive bullish closing HAC-candlesticks, indicating a robust bullish swing on the lower daily time frame.

The lower modified Bollinger band on the main window moves closer to the middle fifty period Moving Average and band deviation set to 0.382, confirming a more stable uptrend.

Daily Chart Projections: Bullish and Correcting

Looking at the daily time frame, the HeikenAshi count indicator shows a collapse of the bullish price rally and a likely prolonged price correction.

The Bollinger-band indicator’s upper threshold currently serves as significant support, forcing a slowing of the downward EURUSD momentum.

H4 Intraday Chart Overview

A collapse of buying supports forces the EURUSD exchange rate to trade below the lower Bollinger band, as revealed on the H4 chart overhead.

We expect a double bottom chart pattern to form after the increase in demand, signaled on 12-01-2021 16:00, which may send the exchange rate towards the fifty periods moving average.

Conclusion and Weekly Price Objectives

As the price of Gold XAUUSD stays stable and gets ready to jump higher. We anticipate investors may be parking their funds in the ancient safe-haven asset, which may send a ripple effect to the EURUSD, bringing an end to the current gains in the Greenback.

No Comments found