EURUSD – Weekly Outlook & Analysis for September 1 2020

EURUSD Forecast & Technical Analysis for Forex

Introduction

The new week will bring excitement to the XM forex platform as we enter into a new month. Let us check out the chart and see where the bias lies in the coming days and weeks.

Fundamentals

Euro Zone

German Factory Orders m/m:

The factory report is gotten from the diastasis press release informing us about the change in new orders placed by the purchasers with the manufacturers during a specific period.

A more significant output release than the forecast is good for the Euro currency, while data that is lower than the expected is terrible for the euro currency.

The forecast is 5.1%, while the previous is 2.9%.

The U.S.

The ISM Manufacturing PMI:

The ISM is responsible for the PMI’s data release based on the research carried out on the manufacturing industry’s purchasing managers because of the managers’ view on the economy.

The outcome of the press release that is greater than 50.0 shows a sign of expansion, but a lower result shows lesser activity.

The forecast is 54.5 while the previous is 54.2

EUR vs. USD Bigger Picture: Upward Trend

EURUSD: Technical Analysis

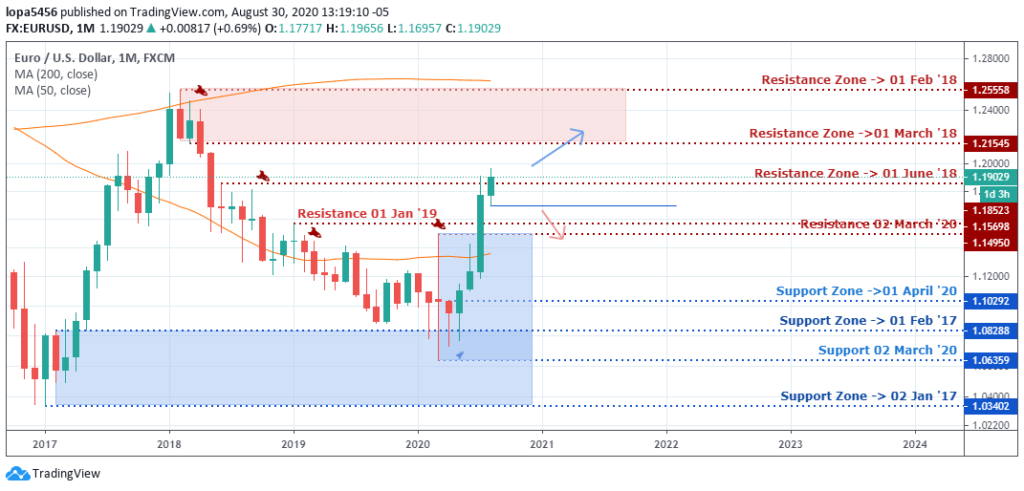

Monthly

Monthly Resistances: 1.14950, 1.18523, 1.15698, 1.25558, 1.21545

Monthly Supports: 1.10292, 1.08288, 1.06359, 1.03402

The August candle is closing in a bullish momentum with a smaller body than the previous month, which signifies that some traders have taken profit. We have few buyers in the market as price approaches the resistance levels of 1.21545 and 1.24000.

The new month will have its surprises as we expect the forex platform to attract both Sellers and Buyers at these psychological levels during trading periods.

However, a rejection at the resistance will bring a reversal of the trend to the downside, showing strength for the US dollar. However, if the bulls are still strong, it will push the price higher again.

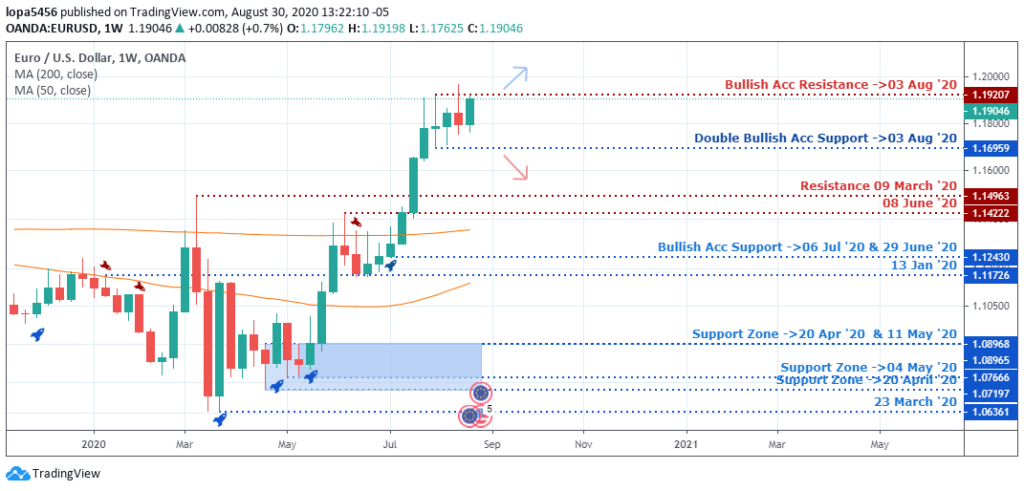

Weekly Chart Bullish

Weekly Resistances: 1.14222, 1.19207, 1.14963

Weekly Supports: 1.12430, 1.111726, 1.07197, 1.16959

The bullish swing to the upside started after the bulls took over the support level of 1.08968 as of April and May 2020. The surge saw the bulls breaking above a previous resistance level of 1.145963 to rally to the recent high of 1.19207.

The trend is bullish from the close of the week. However, the new week will usher a new month, and exciting news will be released from the U.S. economic calendar, strengthening the U.S. dollar in the coming week.

If the U.S. dollar is favored, we will see the trend reversed into a downtrend in the coming weeks.

EURUSD Mid-Term Projections: Bullish Triangle

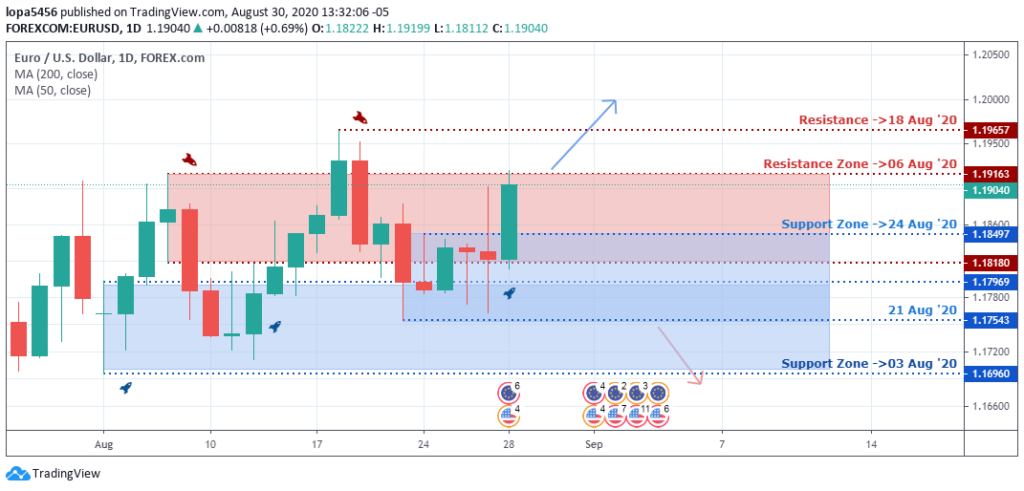

Daily

Daily Resistance: 1.17814, 1.19657, 1.19163, 1.20500

Daily Support: 1.11681, 1.16960, 1.17543, 1.18497, 1.17969

A failed attempt by the bulls to close above this resistance of 1.19657 will usher in the sellers because it is a psychological level for the traders. The bull needs to close above the zones with a strong bullish momentum like larger candles with fewer wicks.

However, if the candles get smaller with longer wicks, you will know that there are higher probabilities that the bears can take over the market should the events favour the U.S. economy.

H4

H4 Resistance: 1.17814, 1.19051, 1.18860

H4 Support: 1.15796, 1.117649, 1.17288

You may wonder from the trading forex platform if bulls can successfully close above the levels where it is now. A bullish close will take the bulls higher for another bullish ride.

However, the resistance level had had multiple retests within the zones, and the bears were able to push back the price, with time we shall await a candlestick pattern showing us a reversal of the trend that will take back the price to the support level of 1.17288.

Bearish Scenario:

A possible bearish scenario based on the four-hour time frame and daily may play out as we await the news coming out this week from the U.S. economy calendar. Any favourable outcome will strengthen the U.S. dollar in the coming days.

Bullish Scenario:

The dollar has been weak since the political crisis was not resolved amid the second wave of the coronavirus pandemic.

Conclusion and Weekly Price Objectives

Europe’s recovery economy is slow but steady as new restrictions are put in place as the summer tourism season is around.

The EUR/USD is that need a careful trading plan because of the new week’s news and the start of a new month.

No Comments found