What are crypto CFD’s?

What is CFD?

The change between the entry and also the exit of an operation happens to be the difference contract (CFD). Cryptocurrency CFDs are negotiable instruments that reflect the movements of the underlying good. It allows gains or losses when the underlying asset moves relative to the position taken, but the underlying real asset is never owned. Basically, it is a contract between the customer and the agent. Working with CFD has several important advantages, and these have increased the popularity of the tools in recent years. This is why it is being used increasingly in the cryptocurrency market. The bitcoin CFDs is one such example.

The importance of cryptocurrency

Till date, there exist much more than one thousand specifications of virtual currencies, most of these are alike to each other and derive themselves from the main fully implemented decentralized true cryptocurrency, the famous bitcoin. Within these systems dealing with cryptocurrency, the integrity, balance and security of records are kept up to date by miners, members of the general public who are into using their computers to help in validating and sealing transactions and supplementing them to general accounting in accordance to a particular time-stamping process. Miners have great financial incentive in doing what they do.

Almost all cryptocurrencies are so designed as to slowly reduce the production of foreign currency by placing a ceiling on the aggregate amount of the cryptocurrency that will circulate at least once imitating precious metals. In comparison to ordinary currencies that generally are kept by the institutes of finance or held in cash, cryptocurrencies may be harder to seize by the authorities. This difficulty stems from the use of cryptographic based technologies. A prime instance of this latest law enforcement challenge arrives from infamous cases like Silk Road scandal, where Ulbricht’s bitcoin was “kept separate and … encrypted”. Coins with Bitcoin code are pseudonyms, albeit additions have been suggested like Zerocoin, which have the potential for true anonymity. Virtual currencies are the way of the future, and as we move forward, there will be more of them flooding the market.

Advantages of a CFD

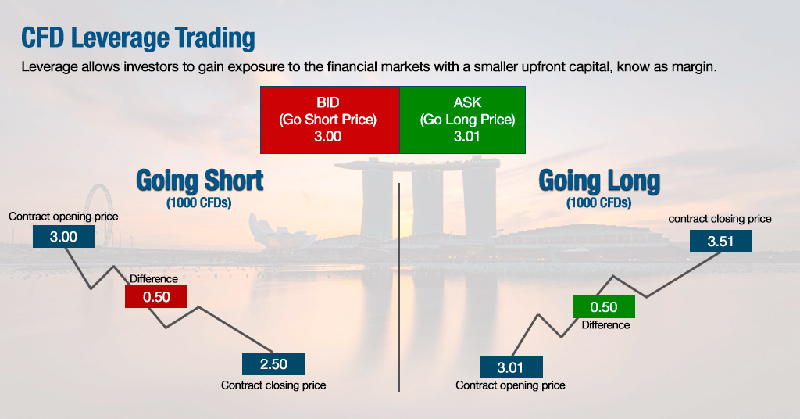

CFDs will provide you greater leverage than traditional trade. The standard leverage in the CFD market is a margin requirement of 2% and up to 20%. A lower margin requirement will mean less capital outlay and higher potential returns for the trader. In addition to this, the CFD market is not subject to minimum amounts of capital or a limited number of transactions for daily trading. You can open an account for only $ 1,000. In addition to this, due to CFDs reflecting the corporate actions which take place, a CFD owner receives cash dividends and he or she participates in equity demergers, which in turn increases the return on the operator’s investment. The CFD position is critical in these cases and you should keep a track of bitcoin CFDs also if trading bitcoins.

The CFD market generally has no short selling rules. An instrument can be abbreviated at any time. Since there is no ownership of the underlying asset, there are no financing or short-term costs. Furthermore, few or no fees are charged for the operation of a CFD. Brokers receive money from the merchant who pays the spread using spread betting. A trader pays the purchase price at the time of purchase and takes the offer price in case of sale or short circuit. Depending on the volatility of the underlying, the spread is small or large and generally fixed. Go ahead and invest. But do so carefully because there are operational risks.

Cryptocurrency CFDs will normally be transacted on standardized contracts (lots). The size of a single contract varies according to the good that is traded, often imitating the way in which the asset is marketed. Silver, as an example, is sold in bags of raw materials in batches of 5,000 troy ounces, and its CFD contracted equivalent will also has a value of 5,000 troy ounces. And in the case of shared CFDs, the size of the contract is usually representative of an action in the company that is trading. To access a position which is replicating the purchase of 500 HSBC shares, 500 of HSBC contracts in CFD must be purchased. This happens to be an alternative way in which CFD transactions are much closer to transactions on the market derivatives, such as betting or spread betting options.

Almost no CFD trading has any fixed maturity in them, and this is another way they are different from betting and spread options. Instead, positions close when you place an operation in the other direction to the one with which it was opened. For example, a purchase position in 500 gold contracts is easy to be closed through the sale of 500 gold contracts. If you maintain daily CFD positions open at the conclusion of the deal, you will be charged a nightly cost. The cost is a reflection of the cost of capital that was lent to you to open leveraged trading. However, this is not always the solution, and the main exclusion of a fixed-term contract. A forward contract will always be having an expiration date at some time in the future, and it also has all the one-day financing costs already contained within the margin. This is another advantage of virtual currencies.

It is no secret that CFDs can be traded across a wide range of markets with different brokers, incorporating indices, stocks, currencies, commodities and more. For example, trading a CFD share is, in many ways, very similar to traditional stock trading, but with further advantages in terms of cost and convenience. It is also possible to market markets such as equity indices through CFDs, which are not accessible to operate directly. However, you should keep in mind that CFDs are a leveraged product and can cause losses that exceed your initial deposit in your CFD trading account. You need to keep a close eye on the CFD position at all times during the course of the period.

CFD Multiplier explained

A multiplier is a commercial instrument based on the use of borrowed capital. Using a multiplier, the operator can control a position that is greater than the amount of funds at his disposal. For example, when you open a position of $ 100 and use a multiplier of x10, your potential income (and your loss) will be calculated as if you were investing $ 1,000. Bitcoin, Ethereum, Dash and Litecoin are the most popular cryptocurrencies in the world. Negotiating them with a multiplier is an opportunity that many investors have been waiting for. The instrument is suitable for both short and long-term operations. With such a high multiplier, contracts for difference (CFD) give you the opportunity to negotiate even the slightest movements in price action. There is a CFD Multiplier called Dash, where the options on offer are x3 and x5.

With the rapid changes we witness in the financial markets, it is a wise idea to take a look at CFD multipliers as they offer you to control a position which is much greater than the funds he has in his hands. But a word of caution, if there is a loss, then the investor stands to lose in the same multiples.