Last XM review update: 28th August 2020

In-depth Review of XM for India

Overview: What is XM?

XM Group is a group of online regulated brokers. Trading Point of Financial Instruments Ltd was established in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10). Trading Point of Financial Instruments Pty Ltd was established in 2015 and is regulated by the Australian Securities and Investments Commission (ASIC 443670). Trading Point of Financial Instruments UK Ltd was established in 2016 and is regulated by the Financial Conduct Authority (FCA 705428). XM Global Limited was established in 2017 and is regulated by the International Financial Services Commission (IFSC 60/354/TS/19)

XM.com is an online Forex and CFD brokerage firm offering an option to trade with ultra-low spreads and more. The firm has options for traders to start with a demo account or open an account to trade on MetaTrader 4, MetaTrader 5, or even XM WebTrader platforms. There are zero re-quotes and zero rejections for the traders to feel comfortable by trading with this trusted global broker.

The company offers CFD’s on Forex, Stocks, Equity Indices, Precious Metals, Energies and Commodities.

Is XM a trusted broker for India?

Yes, it’s is. XM is a very reputed and multi-awarded trading platform. Many traders in India choose XM as one of their preferred CFD brokers for the following good points:

- Spreads as low as 0.6 pips.

- 1000+ trading instruments.

- Excellent promotions. $30 Free bonus.

- Quick withdrawals

- Great customer service.

- Negative balance protection.

- Many regulatory licenses from different jurisdictions.

- Deposit via Fasapay, Neteller, and other popular methods in India.

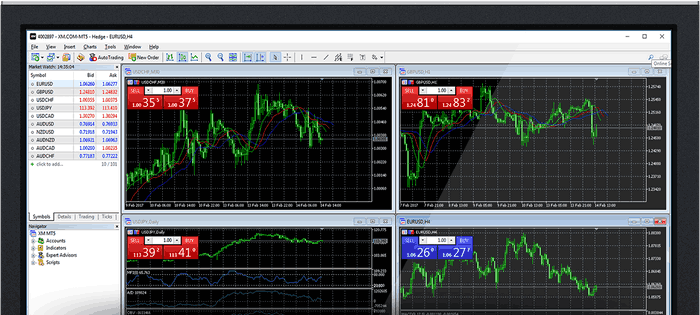

Trading platforms

For the traders looking through XM.com or any brokerage firm, the first focus is on the trading platforms they offer. One of the most sought after platforms is that of MetaTrader 4 or MetaTrader 5. The trading platforms are compatible with desktop, laptop, smartphones, and tablets.

MetaTrader 4 or MT4

MetaTrader4 or MT4 is a useful trading platform offering solutions for trading across various devices and OS. Offering flexible leverages from 1:1 to 888:1 (Leverage applies to all the non-EU regulated entities of the Group. Leverage depends on the financial instrument traded and on the client’s country of residence), the platform is ideal for those going for no-rejection trades. MT4 is available across various devices.

- MT4 for Desktop: Easy execution of trading is possible with MT4 Application. It offers no rejections and flexible leverage ranging between 1:1 and 888:1. It offers 1 single-login access to 8 platforms and with 1 single click allows the traders to trade. The traders can also access 3 chart types and over 50 indicators to help them analyze and strategize.

- MT4 for Mac: XM offers Mac computer option to the traders. There is no need for them to undergo any Bootcamp or go for a parallel desktop. The software allows for hedging and even comes with full Expert Advisor functionality.

- MT4 Multiterminal: Traders can go for the management of various MT4 terminals from a single terminal account. Traders can access up to 128 trading and multiple order types. There are three allocation methods, management, and execution in real-time.

- MT4 WebTrader: XM MT4 WebTrader comes with no download option for both PC and MAC OS. The trading platform is for working directly from the browser and requires simple logging. The active orders are visible on the chart, and there are options of Close By and Multiple Close By trade requests.

MetaTrader 5 or MT5

This platform is another version for trading online available at XM. The traders can look out to access additional 300 CFDs on stocks (shares), and more. It is possible to login to seven platforms from just 1 login ID. There are over 80 analytical objects and great depth of market analysis with the latest prices for the traders using MT5 at XM broker.

- MT5 for PC: The trading platform allows for a single login to seven platforms and gets full Expert Advisor functionality too. Traders can access over 1000 instruments and CFD’s on energies, precious metals, and Forex. The spreads are low, and the platform allows for hedging and offers detailed market depth with latest price quotes.

- MT5 for Mac: XM trading for Mac requires no Boot camp software training. It allows for a diverse range of functionalities to trade the global markets. The 100% Mac native application gives spreads with zero pips and allows for hedging with the one-click trading option.

- MT5 WebTrader: WebTrader allows the traders to simply log in from the browser and without downloading any extra software. The traders can access over 1000 instruments, including stock CFD’s, Forex and more. The software supports all types of trading orders and contains editable properties of graphical objects.

Mobile Trading

Mobile Trading with MT4: XM.com understands the traders’ willingness to trade as they travel or wish to keep an eagles’ eye approach on the market. That is why there are apps with MT4 for the phone and tablet users here.

MT4 for iPhone: The 100% native application of MT4 from XM gets 3 chart types and 30 technical indicators. The traders can also check the full trading history journal and more.

MT4 for iPad: The 100% native application is light and ideal for iPad using traders. The app is easy to operate with the same login ID and password that the traders use for their account on PC or Mac computers. There are 3 chart types to access and with 30 technical indicators, they can proceed to trade with ease.

MT4 for Android: The XM.com users can view and trade from MT4 for Android smartphones as well. They can access this native application with MT4 account login details they have for the Mac or PC Account. There are 3 Chart types to access with 30 technical indicators, and real-time interactive charts with zoom and scroll feature too.

MT4 for Android Tablet: XM traders have MT4 Droid Trader app to help them trade from their Android tablet too. It gives them full MT4 account functionality and real-time interactive charts with 30 technical indicators and more.

Mobile Trading with MT5: The trading platform of MT5 extends its functionalities and features to the mobile phones and tablets. Let us check out the benefits and features of trading through MT5 for a phone app.

MT5 for iPhone: XM traders can access over 1000 instruments, including CFDs on stocks, Forex, Energies, Equity Indices and Precious metals. The built-in market analysis tool and the trading orders support give the traders an upper edge.

MT5 for iPad: Trading with MT5 gives the traders more features and access to trade with 1000+ instruments. The built-in market analysis tools are available to strategize even before risking and buying or selling stocks on the go.

MT5 for Android: MT5 for any Android phone requires traders and investors to download this light app from Google Play. By logging in with the demo account, one can access this Android app.

MT5 for Android Tablet: The traders can trade on all trading order types through this 100% native application. Just open an account after downloading this software from Google Play. The built-in market analysis feature helps in trading over 1000 instruments, including CFDs on stocks and commodities.

Types of Accounts

XM Broker offers four types of Accounts to help the traders pick one to trade.

- Micro Account: The base currency options here are USD, EUR, GBP, JPY, and more. The contract size of 1 lot is equal to 1000. The maximum leverage offered is 1:888. There is Negative Balance Protection for traders not to trade down to negative numbers unknowingly. There is no commission, and the spread is as low as 1 pip.

- Standard Account: XMtraders can opt for this with a contract size of 1 lot equaling 100,000. The currency options are similar to the Micro account. The maximum leverage offered is 1:888. There is no commission charge and the spread on all majors is as low as 1 pip.

- XM Ultra Low Account: The currency is similar to the Micro and Standard accounts. The spread is as low as 0.6pips, and there is no commission on this account type. The contract size here of Standard Ultra 1 lot equals 100,000 and Micro Ultra 1 lot is 1000. The maximum leverage offered is 1:888.

- Shares Account: XM traders have the option of going for this account type that offers no leverage and there is commission too. The spread is as per the underlying exchange though there is negative balance protection to the traders. The base currency is just USD. The contract size is 1 share. Here, the traders can also have an Islamic account. This account does not have a deposit bonus or hedging. The minimum deposit is $10,000.

* Please note that account availability depends on the client’s country of residence.

Commissions / Spreads

Commissions are not on all the account types as we just saw. It exists in the shares account. The XM broker has varying spreads as per the Account types. The Micro and Standard accounts have spread as low as 1 pip. The Ultra-Low Account has spread as low as 0.6 pip. The Shares account has varying spreads. Investors dealing in the Forex markets can avail ultra-low spreads across flexible lot sizes. There are EUR/USD Spread of 1.6 pips (flexible) and GBP/ USD Spread of 2.1pips.

Deposit and Withdrawal Options

The minimum deposit amount for Micro and Standard account types is $5, the Ultra-Low costs about $50, and the Shares account a minimum deposit of $10000.

XM Group is accepting the most commonly used local payment methods which include Credit/Debit Cards, Neteller, Skrill, Bank Wire Transfer, etc. There is a method of creating a Demo account at XM. Here, the traders will get a virtual balance of $100,000.

It is easy to get the withdrawals, and the company takes 24 to 48 hours for processing the same. At present, the site is not accepting deposits via PayPal.

XM Bonus & Promotions

XM.com is giving away a free $30 trading bonus* ( no deposit required), 50% deposit bonus* up to $500, and 20% bonus* up to $4,500.

*T&C apply. Please check their website.

Leverage

XM has flexible leverage between 1:1 and 1:888. Trading across 7 asset classes and with an ability to monitor risk exposure on a real-time basis, the XM traders get a superb deal. The leverage is ideal for investors to make the most even from a small investment and help in minimizing the losses. The traders get an option to choose their preferred risk level and monitor their margin. The traders will get to see their free margin and used margin to analyze for further investment.

Customer Support

In a bid to stand tall amidst competition in the stock and Forex trading world, XM.com has to ensure superb customer support. Customers might have queries pertaining to using any of the features of their MT4 or MT5 application. They may face difficulty at any time of the day if their real-time monitoring faces any glitch. The customer support team is quite efficient by offering support through Live chat. This support team is available 24 hours a day all through the year. Traders can also access the same team to help via email and telephone too. XM has recently won the Capital Finance International Magazine award for Best Customer Service Global in 2019 and the COLWMA winner of the Best FX Service Provider in 2019. These speak volumes regarding XM and its ideology about customer service.

Regulation: Is XM regulated?

Yes, XM has regulatory licenses from the reputed organizations.

XM Global Limited is regulated by the IFSC or International Financial Services Commission.

Trading Point of Financial Instruments UK Ltd is regulated by the FCA or Financial Conduct Authority.

Trading Point of Financial Instruments Ltd is regulated by the CySec or Cyprus Securities and Exchange Commission.

Trading Point of Financial Instruments Pty Ltd is regulated by the ASIC or Australian Securities and Investments Commission.

XM: Final Verdict

The best aspect of XM brokerage firm has to be its vast offering in terms of trading platforms. The firm offers the most reliable MetaTrader 4 and MetaTrader 5 platforms for dealing with a wide range of trading instruments. The firm manifests the traders to do business with Forex and CFDs on stocks, equity indices, energies, precious metals, and commodities. The firm also presents four very crucial account types with features to make share and stock trading effective. The firm’s speciality lies in not taking any commission on three of the four account types. The firm also has a Negative Balance protection feature to the traders from bankruptcy, especially those who do not know much about the trading and investment. This is why traders today are seeking XM.comto do trading globally.

No reviews yet