What is Cryptocurrency?

Very few people are aware of this that cryptocurrencies have come out as a by-product of yet another invention. Satoshi Nakamoto, who is the inventor of Bitcoin, which was the very first and also the most significant cryptocurrency, never tried to invent a coin. In his Bitcoin announcement at the end of 2008, Satoshi claimed to have developed “a point-to-point electronic payment system”. His aim was inventing something that many persons could not create before; digital cash. After seeing that all centralized attempts failed, Satoshi attempted to build a digital cash system without a central entity. It was an attempt to create cryptocurrency exchange as a point-to-point network for sharing files. This important decision marked the birth and the beginning of the cryptocurrency craze.

Very few people are aware of this that cryptocurrencies have come out as a by-product of yet another invention. Satoshi Nakamoto, who is the inventor of Bitcoin, which was the very first and also the most significant cryptocurrency, never tried to invent a coin. In his Bitcoin announcement at the end of 2008, Satoshi claimed to have developed “a point-to-point electronic payment system”. His aim was inventing something that many persons could not create before; digital cash. After seeing that all centralized attempts failed, Satoshi attempted to build a digital cash system without a central entity. It was an attempt to create cryptocurrency exchange as a point-to-point network for sharing files. This important decision marked the birth and the beginning of the cryptocurrency craze.

These were the missing pieces which Satoshi managed to find to make digital money. The real reason is that it is a bit scientific and multifarious, however if you understand it, you will get to know much more about cryptocurrencies than the average person. Therefore, let’s try to understand this as simply as we can.In order to make digital cash you need a payment network which has accounts and balances as well as transactions. This much is easily understood. One of the main problems that each payment network needs to solve is the avoidance of the double expense: to prevent an entity from spending the same amount more than once, in this instance twice. Typically, this job is completed with the help of a central server that tracks the balances.

In decentralized networks, you do not have the services of this server. Hence it is necessary that every entity in the network perform this work. All pairs which occupy the network must have a list of all transactions in order to check if the future transactions are all valid or an attempt to double the spending. But how can these entities maintain a consensus on these documents? If the network colleagues do not agree on a single minor balance, everything stops. They need absolute consent. Usually, it takes, once again, a central authority to declare the correct state of the balance. Nowadays, you will find cryptocurrency news almost every day.

What is a cryptocurrency exchange?

These are online platforms in which it is possible to exchange a cryptocurrency with another cryptocurrency (or with a fiduciary currency). In other words, depending on the cryptocurrency exchange, it is like a stock exchange or an exchange of currencies (at the airport or in the bank). If you have followed cryptocurrency news, you will find that there exist 3 types of exchanges. The first is ‘traditional cryptocurrency’ exchanges. When you start off on cryptocurrency trading, you will find that this platform is more or less the same as a traditional stock exchange. Other types of exchanges are direct trading exchanges, cryptocurrency brokers and cryptocurrency funds. Cryptocurrency trading is taking off in a big way nowadays.

What is a cryptocurrency in reality?

If you remove all the hype around cryptocurrencies and boil it down to a simple explanation, you will find regulated entries in a database which no one has the power to edit without meeting specific conditions. It might not seem normal or ordinary, but this is exactly how you can define a currency. If you take the money lying in your bank vault: what’s more than the admissions in the database which could only be changed after specific conditions are met? You can also take coins and physical notes that you see: what are they if not more than restrained entries existing in the public physical archive which can only be changed if it matches the condition that physically holds coins and banknotes? Money is a verified item in a sort of database of accounts or balances and transactions.

Cryptocurrency mining

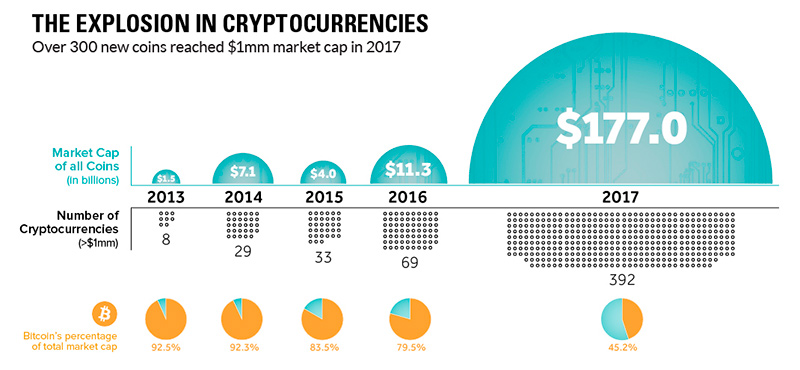

You may have heard about Bitcoin, the initial decentralized cryptocurrency started in the year 2009. Similar kind of digital currencies have infiltrated the global market ever since, together with a Bitcoin spin-off named Bitcoin Cash. Crushing speed can be achieved if you take the time to learn the bases correctly. At the same time, there are also many ways in which you may have lost money. Bitcoins are not a good option for beginner miners who work on a small scale. The current invest cryptocurrency costs and maintenance costs, not to mention the great mathematical difficulty of the process, simply do not make consumer hardware cost-effective. Now, Bitcoin mining is reserved only for large-scale operations.

Feathercoins, Litecoins and also Dogecoins, are the three cryptos based cryptocoins that yieldthe best cost-benefit ratios for beginners. With the current value of Litecoin, a person can earn between 50 cents and $ 10 a day using a consumer-grade mining hardware. Dogecoin and Feathercoin would get a slightly lower advantage with the same data mining hardware, but they are becoming increasingly popular every day. Pee coins can also be a plausibly decent return on your deal of time and efforts. As more and more people connect the cryptocurrency fever, their choice may be harder to extract because more costly hardware is required to uncover coins. They force you to invest a lot if you want to continue extracting that currency, or you can take your profits and shift to an easier crypto coin. A lot of people invest cryptocurrency for this.

Profiting from invest cryptocoin

If you are looking to earn money as a secondary income, then it is better to invest cryptocurrency with cash instead of extracting them, and then save them in hopes that they will rise to value as gold or silver bars. If you have some digital dollars and spend them somehow, then you may have a slow way of doing it with mining. Intelligent miners must keep electricity costs below $ 0.11 per kilowatt hour; the extraction with 4 GPU video cards can generate revenue from $ 8.00 to $ 10.00 per day (depending on the chosen cryptocurrency), or about $ 250- $ 300 a month.Now, there’s a small chance that your digital currency will be rising in value with Bitcoin at some point. So maybe you could find yourself sitting on thousands of dollars in cryptocurrencies.

Conclusion

If you decide to invest in cryptocurrencies, you need to follow a few steps. Firstly, download the app called “coinbase’”. After creating the coinbase account, log in and check out the daily volatility. Then add a payment account and you’re all set to buy. So tap the “buy” button again. You will also need a bitcoin wallet. It is a collection of private keys, however it may also refer to client software which is used to manage those keys in order to transact on the Bitcoin network. As a means of payment, cryptocurrency is fast picking up pace and if you are willing to invest time and resources, there are plenty of opportunities to profit from them in the long run.