BTCUSD Weekly Outlook and Bitcoin Fundamentals, 4rd June 2021

BTCUSD Forecast and Fundamentals for Bitcoin

Introduction

The Bitcoin BTC is preparing for the correction phase of the market therefore the weaker traders and OlympTrade investors should sell off their bitcoins to stronger hands.

The market is still bullish in its overall trend. Some institutions and Indian brokers believe that the price value of BTC can still reach the projection of $100000 this year.

BTCUSD Technical Analysis

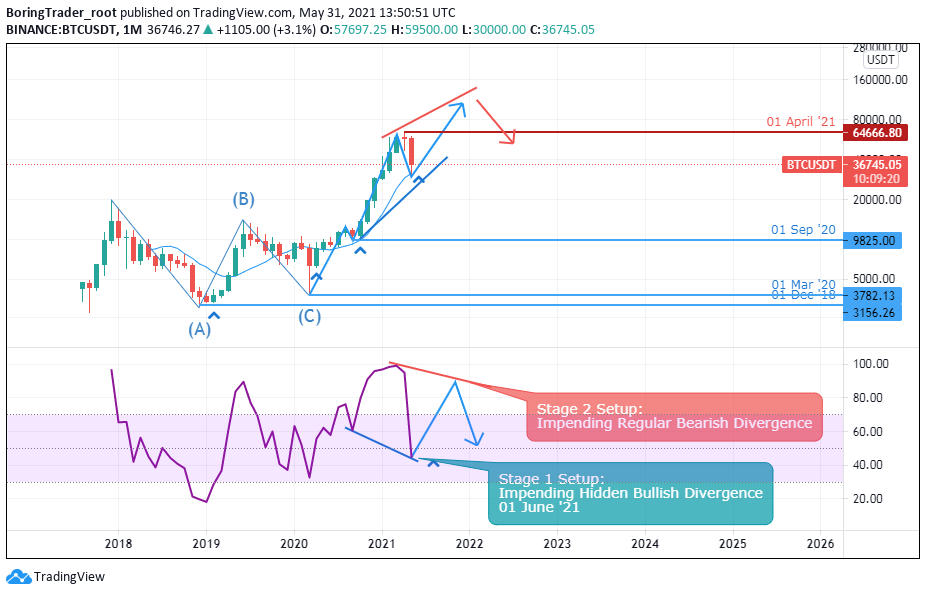

Monthly Chart

Monthly Resistance Levels: 65000, 75000

Monthly Support Levels: 35000, 30000

The bitcoin closed the month on a bearish note, having seen the previous month closed with an indecision candle. The candlesticks pattern on the monthly chart is showing a reversal pattern if the bears can hold the resistance zones in weeks to come.

We expect the new month to begin with some bullish momentum as the support level is resisting the bears advances from the 35000 levels. The Bulls will try to retest the high of the resistance to retake the market, if they should succeed the bullish run will continue but if the plan fails, the bear’s rally will take out the 35000-price level of the support zone.

Weekly Chart

Weekly Resistance Levels: 65000

BTCUSD Weekly Support Levels: 35000, 30000

From the weekly time frame, you can see that the indicator is in the oversold zone, we expect the price of bitcoin to starts going up in the new week if all things being equal. BTCUSD market is still bearish as you can see.

The psychological levels are the resistance point of 65000 and 30000 levels of the support zones. The break out of price from either side will determine the direction of the market.

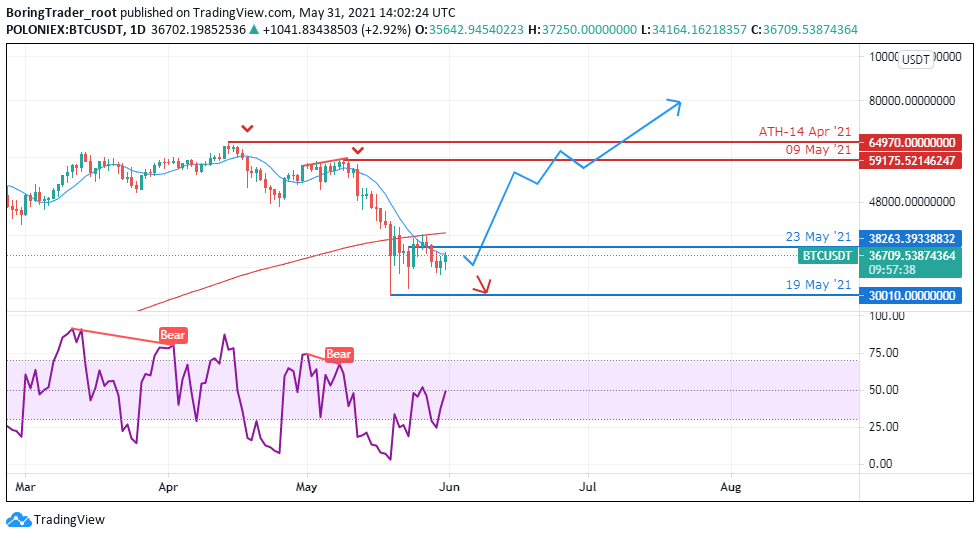

Daily Chart

Daily Resistance Levels: 65000, 45000

Daily Support Levels: 35000, 30000

From the daily time frame, you can see that the indicator is in heading out of the oversold zone. We expect the price of bitcoin to start going up in the new week if the price can close above the 40000 levels.

The market is still bearish as you can see the psychological levels are the resistance point of 65000 and 45000 levels of the support zones. If the bulls can push the price higher than the 45000 levels will attract buyers to retest the resistance zones, if the bears should close below the 30000 levels the price of bitcoin will drop further.

Bullish Scenario:

The daily chart shows that there is bullish momentum from the support zones (30000) for a rise in price if they can dominate the zones. We need to get that bullish surge for more buyers to come on board.

Bearish Scenario:

The weekly chart still favours a bearish move having dominated the market from the resistance levels of 65000. The bear’s rally will expect a correction of the trend before another swing if the bulls retest fails.

Bitcoin BTC News Events

Indians’ frontline doctors have been in battle with the COVID-19 infections since the second waves have put many patients into exhaustion and fear likewise the frontline doctors. From the Doctors point of view, they have been traumatized by being forced to choose which patients to save first in the crisis of insufficient supplies of oxygen and medicine.

A founder of a Charity group that was helping to set COVID field hospitals Ravikant Singh shares his experience on the numbers of days that they struggle to sleep some nights. He shared how they could not save many lives because of the lack of oxygen, also how they worry about their family members so that they don’t infect them because the virus could lurk anywhere and everywhere.

Therefore, if doctors cannot save their own lives from the virus, how will they save the lives of others? Says Singh during his interview with AFP.

The Reserve Bank of India clarifies that there is no Ban on Bitcoin or on banks servicing accounts on cryptocurrencies.

Banking operators may do their due diligence for customers involved in digital assets. They are to carry out the due diligence process in line with the standards set on the regulatory process such as KYC (Know Your Customer), AML (Anti-Money Laundering), PMLA – Prevention of Money Laundering Act, and CFT – Combating of Financing of Terrorism.

All the regulatory body are to ensure dealers in cryptocurrencies comply with relevant provisions towards overseas remittances under FEMA -Foreign Exchange Management Act.

India’s IAMAI-BACC – Internet and Mobile Association of India–Blockchain and Crypto Assets Council sets a self-regulatory code of conduct to ensure willing KYC and tax compliance by all crypto exchange.

The IAMAI-BACC welcomes the step RBI took by advising the banks not to use the 2018 circular that called for the non-acceptance of crypto-related transactions of customers.

BTCUSD Conclusion and Projection

A healthy trend must have an impulse and a correction phase for it to display the market sentiment, psychology of traders and human behaviors. The global crypto market cap is at $1.62trillion as at the time of the report and the volume of all stable coins is at $92.46 billion which is 84.98% of the total crypto market 24-hour volume.

We expect the bitcoin to have a bearish phase in the market because the daily chart shows that the bears have momentum and the Bulls could not close above the 40000 level for a bullish run. A close below the 30010 low will bring bitcoin to a lower low on the daily time frame.

No Comments found