Bitcoin to USD ( BTC/USD ) Weekly Outlook , May 3 2019

BTC/USD Forecast and Technical Analysis & Fundamentals for Cryptocurrencies

Introduction

The month of April finally came to an end and the long-anticipated breakout of bearish resistance is flagged at the opening price of May’19. By this, a bottoming is confirmed on the monthly time frame and the bulls have a firm grip on the Bitcoin price.

Bitcoin Fundamentals

Regulatory Adoption

9 Fintech Blockchain firms Authorized by South Korean Financial Regulator

In a report by Korea Times on 2nd May ’19, nine Fintech corporations have lately been approved by the nation’s FSC (Financial Services Commission).

According to the report, over a hundred companies applied for the program and included in the sandbox is an offered service by Woori Bank which enables exchange and withdrawal of cash by customers at parking lots, and restaurants within the airport premises.

Intercontinental Exchange took advantage of the ‘Crypto Winter’ to accumulate Digital Assets for Bakkt

On the 2nd of May, Reuters reported that (ICE) Intercontinental Exchange allegedly took advantage of “crypto winter” to obtain crypto assets for its trading platform Bakkt. November of 2018 saw the crypto market experiencing dual digit loss which brought bitcoin lower than the $5.600 mark.

Due to the ongoing consultation with the United States Commodity Futures Trading Commission, Bakkt postponed their launch which was to commence in January 2018. The Chief Executive Officer Mr. Sprecher purported in February that launch might commence in 2019. He cited the delay as an opportunity for ICE to acquire talents

It’s been reported that Bakkt acquired Digital Asset Custody Company a crypto custodian service company. Bakkt applied to operate as a trusted company with the New York Department of FINANCIAL services thereby allowing them to perform as Qualified Custodian for digital assets.

Technical Analysis

BTC/USD: Monthly Chart

As mentioned in the introduction, the bearish resistance on December ’18 and January ’19 of Q1 gave way to bullish pressure as shown on the monthly time frame illustration. Here we see institutional investment (money) coming into the space, therefore, increasing speculative adoption.

BTCUSD: Weekly Chart

The golden cross of the MACD indicator attached to the above weekly chart confirms the beginning of the bullish trend as the bulls continue to develop higher peaks & valleys. A bullish accumulation setup signaled on February 25 ’19 in combination with the golden cross, emphasized the need to maintain a bullish presence.

BTCUSD: Daily Chart

Do you notice an increase in bullish presence on April 06 ’19? Well, the triple bullish accumulation support served as a springboard for the Bitcoin price forcing the trend back into a bullish expanding channel as shown above.

The expanding channel was built from alternating bearish and bullish divergence setups on April 25 and 29 ’19. Most recent is the bullish divergence which is responsible for driving price towards the $6000 round number mark.

BTC/USD: 4-HR Chart

From a 4hour chart perspective, the bearish divergence on the daily chart started by initiating a break down of triple bullish accumulation on April 23, serving as early short selling entry signal for the pair.

On April 26 and 27 ’19, the bulls continued to violate bearish resistance levels at the 15th and 11th hour of the respective dates. Speculative adoption continued to increase on major Bitcoin broker platforms as the pair skyrockets by about 9.0% and risk exposure of 2.6%.

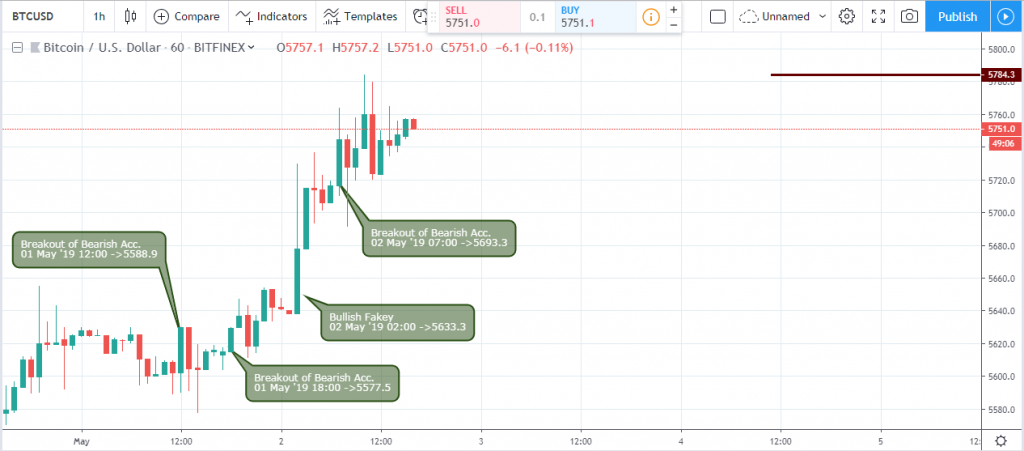

BTC/USD: 1-HR Chart

The above 1hour chart shows the bulls breaking out of bearish resistance on the 12th and 18th hour of May 01 ’19 preparing the shooting the BTCUSD into a bullish trend on major crypto brokers like the Bitfinex exchange seen above.

Conclusion and Projection

Now that we have a bottoming confirmed across the cryptocurrency markets, it’s important to trade with protective stops when trading on margined accounts. HODLing bitcoin and altcoins on crypto broker platforms, on the other hand, maybe a safer alternative to trade cryptocurrencies at this point.

No Comments found