BTCUSD Weekly Outlook and Bitcoin Fundamentals , 28th January 2021

BTCUSD Forecast and Fundamentals for Bitcoin

Introduction

The Bitcoin BTC continues to shed the gains attained from December into the early parts of January ’21 as revealed on some India brokes sites. Many believe that miners may be locking in profits made at the 41K mark.

This week’s post covers the important news events and chart patterns driving the BTC price lower. Let’s get into it.

BTCUSD Technical Analysis

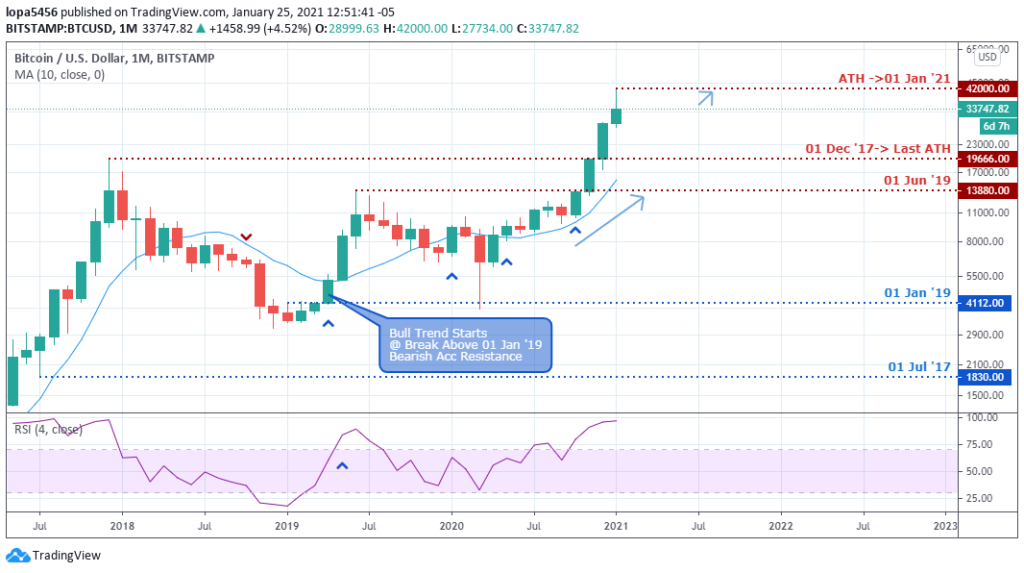

Monthly Chart

Monthly Resistance Levels: 42000

Monthly Support Levels: 23000, 20000.00, 25000

The chart above clearly shows the BTCUSD in an established bullish trend after the RSI indicator entered the oversold area on 01 May ’19.

A price close above the 2017 ATH confirms the start of a new impulse wave, and the recent price slowing still shows no correction in sight.

Weekly Chart

Weekly Resistance Levels: 40425.00, 37934.20

Weekly Support Levels: 27000, 25500

The relative strength Index exits the overbought area on the weekly time frame for the first time since 12 October ’20.

Although many novice traders may panic at this event, history shows that the smart money will start to scale in a long direction at this level.

Daily Chart

Daily Resistance Levels: 41999.99

Daily Support Levels: 31975.0, 24244.0, 18299.00

So far, so good, the BTCUSD has not succeeded at breaching the 30420.00 support, a level if broken, will likely lead to a buoyancy effect, pushing the Bitcoin price upward.

The recent price correction of the BTCUSD by roughly 27.3% started after the regular bearish divergence on 09 January ’21.

Bullish Scenario:

A correction in the BTCUSD exchange rate below the ten weekly moving average will serve as an entry signal in anticipation of a bullish continuation, as the RSI now trades below the level-70 (weekly-TF).

Bearish Scenario:

The bears show strength on the daily and H4 time frames and struggle to breach the 30250.00 support as major cities in the world remain in lockdown from the COVID-19 pandemic. We may see the BTCUSD exchange rate going as low as hitting the 29K level if the 30250.00 level is breached.

Bitcoin BTC News Events

The Reserve Bank of India is reported to now explore the likelihood of a digital currency almost a year after the overturn of the crypto business ban by the Indian Supreme court.

A recent booklet released by the RBI-Reserve Bank of India looks into a need for a digital equivalent for a fiat currency. The RBI speculates on a need to implement a use case for a digital currency.

The RBI highlights Indian local governments and regulators’ skepticism, despite the global adoption rate of cryptocurrencies.

The possibilities of a digital currency by the RBI may spark an increase in India’s cryptocurrency adoption. The bank further reports a 43% value increase and a 12.5% volume increase since 2011.

The technology and digitally inclined generation may further the adoption rate.

A growth in institutional adoptions is noticed as Rothschild Investment Corporation raised its stakes in GBTC.

Rothschild Investments holds 30,454 shares in GBTC-Grayscale based on a filing from the SEC Form 13F-HR or institutional manager maintaining report.

With more than 20 billion USD worth of assets under management, GBTC raised 217.1 million USD in average weekly weekly-inflows during Q4, setting a new high record.

Conclusion and Projection

Newbie crypto investors are starting to panic as the BTCUSD slumped to the 28.8K mark last week.

Being in the crypto market for over five years,

No Comments found