EURUSD – Weekly Outlook for 12th June 2021

EURUSD Forecast for Forex

Introduction

After a disappointing week for some brokers, investors and other participants, we can see that the weekly candle ended with a Doji candlestick formation.

Market participants could not decide the direction of the market, having seen the result from the job data that was released came in below expectation on the forex platform.

EURO and US News

The European Central Bank meeting usually takes place about 8 times a year. The policymakers change their statements slightly, depending on the outcome of their meetings and findings.

They use such statements to communicate with investors, institutions and retail traders about the economic conditions that influenced their decision in interest rates (monetary policies).

The discussion shows their projection of the economic and future decision they have taken. Therefore, a statement from the meeting that is hawkish is good for the currency while a dovish statement is not suitable for the currency.

The tapering of the Federal Reserve’s monetary stimulus of the COVID-19 pandemic is attracting the attention of investors as the program will soon begin.

Last, the dollar is finding support ahead of the inflation data that will be released this week as participants wait for the outcome of the publications.

The Consumer Price Index (CPI)

The data shows changes in goods and services different consumers have purchased within a certain period.

Data comes out after 16 days of the month. On the forex platform, traders and investors pay attention to the details because a rise in prices of goods and services will lead the Central bank to raise interest rates as a containment mandate towards inflation and inflation is important to currency valuation.

The forecast is 0.4% while the previous was 0.8%, therefore, an outcome greater than the forecast is good for the currency while a lower outcome is not suitable for the currency.

EURUSD Technical Analysis

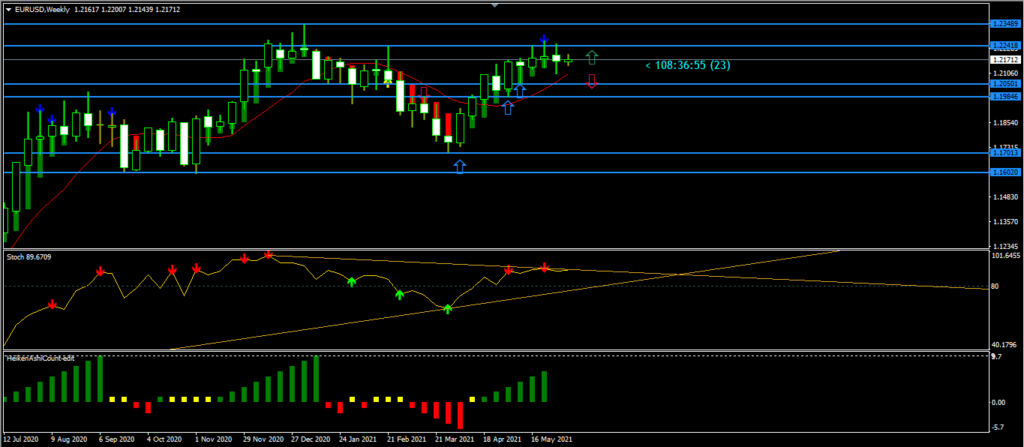

Weekly Chart Bullish Swing

Weekly Resistance Level: 1.23489, 1.22418

Weekly Support Level: 1.20501, 1.19846, 1.17013

The EURUSD pair is still bullish on the weekly chart having dominated the market right from the support zones of 1.17013. The pair had enjoyed a good bullish run for weeks as the dollar remains weak because of the effects of the COVID-19 pandemic which is affecting the economic activities of the countries in the world.

A close above the high of 1.23489 will attract more long positioned traders to take the price to another new high.

We expect some data to be released during the week which will also touch light on the economic strength of the currency and it will influence investors, traders and institutions on the direction of the pair. If the fundamentals are favourable to the U.S dollar, we may see the Bears take over the market from the zone for a swing low towards the 1.19846 support.

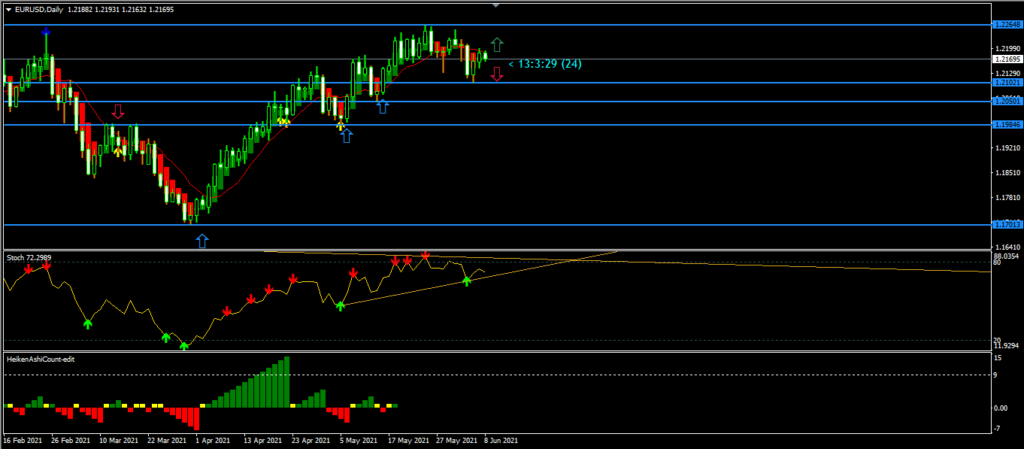

Daily Chart Projections: Bullish

Daily Resistance 1.22648

Daily Support 1.21000, 1.19755

The new week has a lot of key fundamental issues that will stir the direction of the pair in the areas of inflation and consumer price outcome. Also, the ECB will meet as well as the FOMC during the week.

The upcoming event has forced most investors to sit on their hands while waiting for the outcome of the meetings. If the outcome of events should favour the Euro, we may see the EURUSD pair shoot up for an upward surge.

Likewise, if the outcome of events favours the US dollar, we shall see the market sentiments shift in favor of the bears, which will probably run past below the 1.21000 support on the daily chart.

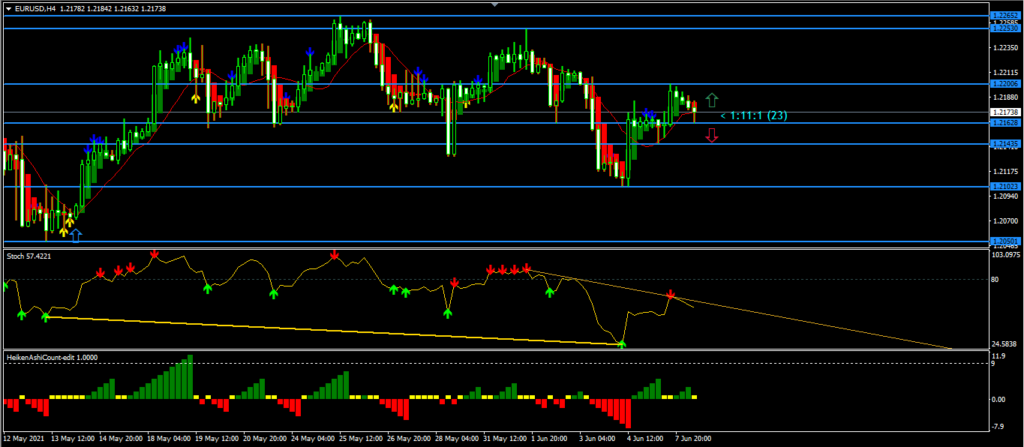

H4 Intraday Chart Overview

4 Hour Resistance 1.22652, 1.22530

4 Hour Support 1.21628, 1.21023, 1.21435

The 4 Hour time frame shows the EURUSD pair has been ranging within the 1.22652 and 1.21435 levels for some time. The retail trader’s sentiment is bearish having seen the resistance zone hold for long.

However, the IGCS gauge shows that about 35% of retail traders are net-long on EURUSD, while the downside exposure had an increase of 12.37% and 2.39% over a daily and weekly basis, respectively.

Some analyst thinks EURUSD may rise because most retail traders are net-short and because of the combination of current sentiment and recent changes may bolster bullish tone.

Conclusion and Weekly Price Objectives

The currency market will face a slow activity as traders will be in a holding pattern ahead of Thursday when US inflation numbers will be published and the European Central Bank meeting will take place.

While waiting, investors will process the G7 corporate tax proposals for the next line of action.

No Comments found