EURUSD – Weekly Outlook for 16th December 2020

EUR to USD Forecast for Forex in India

Introduction

Vaccine roll-out boosts global markets and a similar boost in the Euro from hopes of a good Brexit.

The EURUSD is green across India forex trading platforms following the recent developments with the coronavirus vaccine and a lifting of the Eurozone lockdown.

This post will go over the general news events and round up with the technical charts, identifying trends and significant price levels.

Fundamentals

Euro Zone and US News

The roll-out of the COVID-19 vaccine in the United States increased investors’ confidence. A boost in STOXX Europes’ share index set optimism following news of an agreement between Brussels and London towards a Brexit trade agreement. The report led to a jump in the Euro’s price against the USD as the Asian session opened on December 14, 2020.

There’s a general boost in market sentiment as the market opened due to advances made on the COVID-19 vaccine.

Let’s move to Wall Street. The DJI Dow Jones Industrial Average increased by 0.76%, the Nasdaq Composite IXIC gained 1.31%, and the S&P 500 SPX added 0.86%.

The US Dollar Index DXY dropped 0.025%, as the EURUSD appreciated by roughly 0.16% to $1.213.

On December 15 to 16, 2020, the Fed will be meeting, which analyst believes will increase USD pairs’ volatility.

According to Tapas Strickland, economics director at NAB, a surprise twist by the Fed could result in an upward surge in Treasuries’ value and a slump in the USD.

Also, in the news, a top Democrat gave clues to likely compromise that Republicans may not be able to object.

According to Reuters, reports suggest a split in two of the $908 billion relief plan would ease approval. Stimulus talk is also believed to set a resistance level on Gold (XAUSUSD) that capped its price below 1,840 an ounce.

EURUSD Technical Analysis

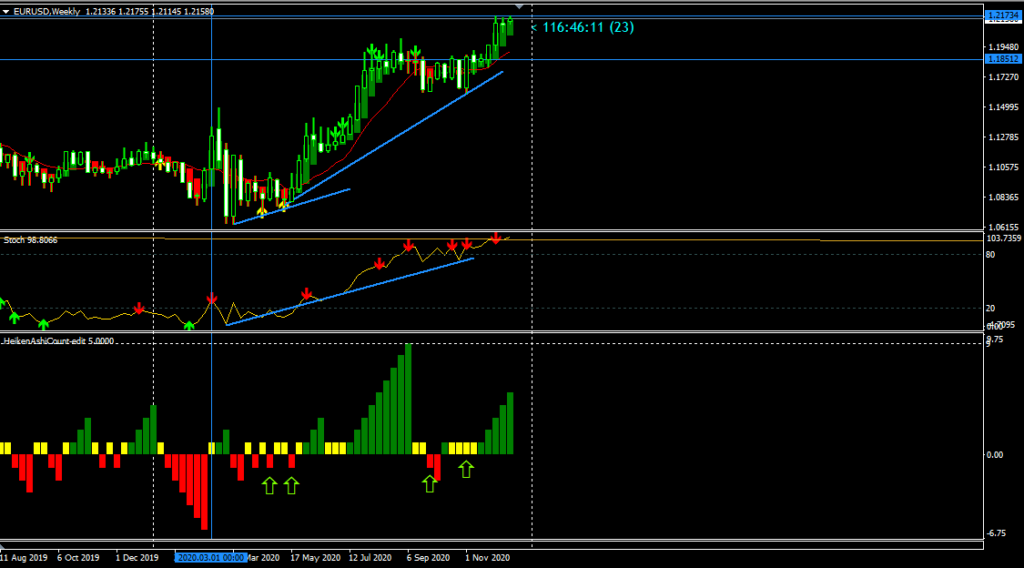

Weekly Chart Bullish

Both stochastic and Heiken Ashi trend trackers attached to the chart sub-window confirm the weekly trend of the EURUSD on March 03, 2020.

Combined with a break of sellers’ accumulated resistance on May 17, 2020, the bullish momentum was immense, leading to a roughly 10.7% rally in the EURUSD exchange rate.

As the trend grew, profit taking actions created room for further opportunities to scale into the bullish trend on June 21 and September 27, 2020.

The 1.18512 support level is a suitable correction area to jump back into the bullish trend. For now, we’ll suggest closing with profits in a bull market on the Weekly-TF.

EURUSD Mid-Term Projections: Bullish

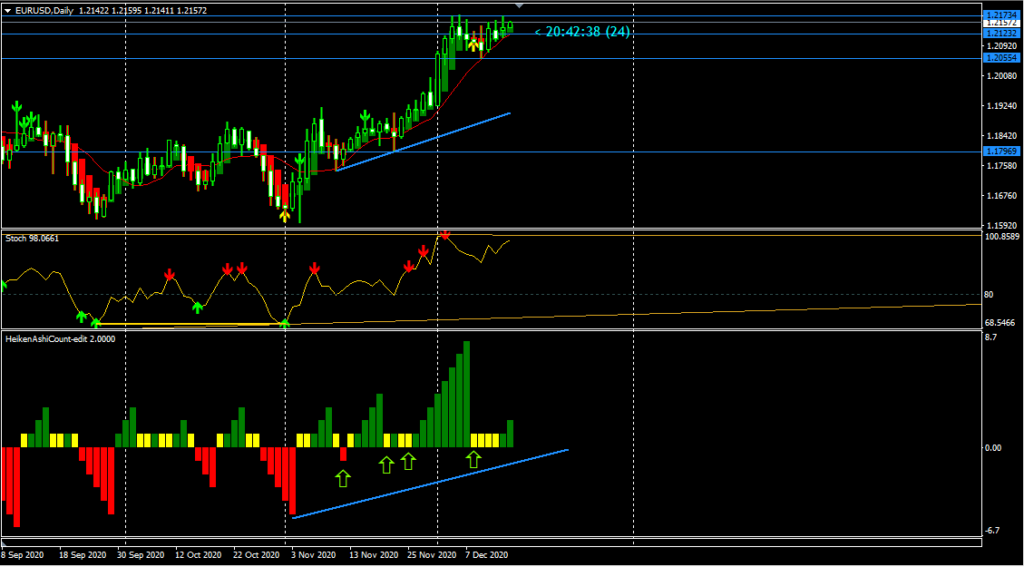

Daily

Daily Resistance: 1.21734

Daily Support: 1.20554, 1.17969

Following a break of sellers’ resistance on November 03, 2020, the bulls assumed control of the market and established a stable upward trend.

Similarly, the Heiken Ashi bars at the lower sub-window joined the bullish trend narrative, indicating re-entry levels towards the upside.

The daily time frame remains bullish but facing resistance at 1.21734. A break beyond that level will reinforce the up move.

The stock-trend oscillator continued to set higher peaks while trading above the level-80, indicating a good uptrend.

Conclusion and EURUSD Weekly Price Objectives

With the Daily time frame also in a strong bullish trend revealed by a series of bullish closing Heiken Ashi bars on the sub-window, we expect a and a likely correction of the positive trend.

No Comments found