EURUSD – Weekly Outlook for 16th March 2021

EURUSD Forecast for Forex

Introduction

The feedback seen on the forex brokers results from the AstraZeneca COVID-19 shots causing an issue in France, Germany, and Italy due to the side effects that some people have experienced.

EURO and US News

French Final CPI

The CPI data is released about 14days into the new month after the consumers’ price changes and services are ascertained from the survey.

An outcome greater than expectation is better for the currency, while a lower outcome affects the Euro.

Actual 0.0%, Forecast -0.1%, previous -0,1%

FOMC

A note of caution is in the air as most traders and investors await the outcome of the Fed’s policymakers’ meetings which is due in some days to come.

The feds are to give their opinions about the US economy and decisions on monetary policies. Investors hope to hear a strong message from the Fed favoring the financial market to strengthen the US dollar.

EURUSD Technical Analysis

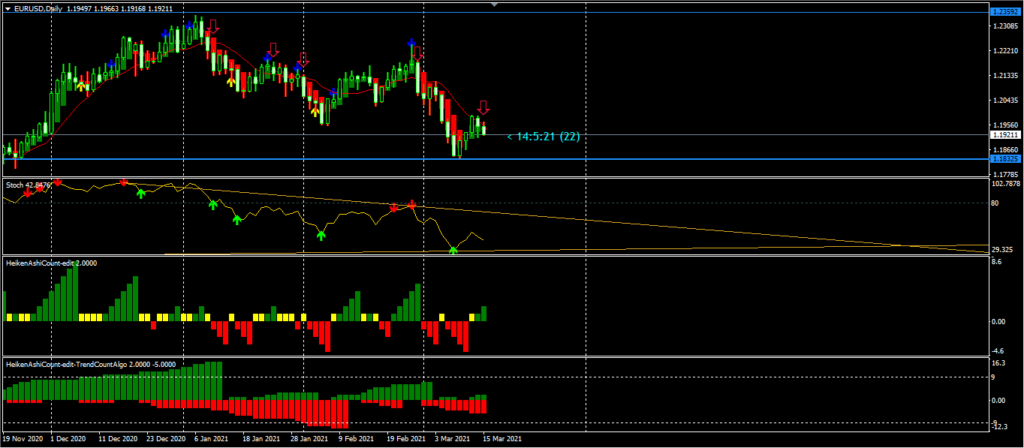

Weekly Chart Bearish Starts

Weekly Resistance Level: 1.23592, 1.21791, 1.21819

Weekly Support Level: 1.19513, 1.20223, 1.15992

The weekly chart shows bears momentum building up as they rally the EURUSD pair down for a downtrend.

From the stochastic indicator, you can see that the price is in an overbought zone for a possible reversal in the coming weeks; the price may likely drop down to a 1.15992 support level.

The sellers need to close below the 1.15992 support level if it must continue its’ trend.

However, the support is a good zone for the bulls to push back the price up to 1.23592 resistance level if the seller’s momentum should fail.

EURUSD Daily Chart Projections: Bearish correction

Daily Resistance Levels: 1.23592

Daily Support Levels: 1.18325

The EURUSD pair on the daily chart shows that the pair is on a downtrend, creating lower peaks and lower bottoms.

You can see that the bearish daily candles are more prominent, and it has broken and closed below the recent support of 1.19560; we expect the bearish run to continue.

The price is likely to retest the support level of 1.18325 in some days to come on the forex platform.

Most traders will be watching if the Euro will be of advantage against the US dollar around that region or the dollar will be more vital to close below the zone.

H4 Intraday Chart Overview

H4 Resistance levels: 1.22385, 1.21129, 1.19895

H4 Support Levels: 1.18325

The EURUSD pair had some bullish run recently before the price hit a previous support zone of 1.19895, now acting as a resistance.

Therefore, if the price can close above the zones, we may see a swing high to the next resistance of 1.21129, but if the bulls cannot close above the 1.19895 levels, we shall see the US dollar make gains against Euro to like close below the 1.18325 for a bearish trend rally.

Conclusion and Weekly Price Objectives

As week await the Fed meeting outcome, most investors seek a haven as most economic situations are getting better while they await the central bank reaction.

The WHO has assured the Eurozone residences not to panic because there is no proven link to blood clots’ rumor from recently administered vaccines.

However, we may not see the market react that much until the Fed meetings and other central banks. The EURUSD remains bearish on the daily time frame.

No Comments found