EURUSD – Weekly Outlook for 29th April 2021

EURUSD Forecast for Forex

Introduction

This week the U.S. Federal Reserve committee is to hold their meetings and Jerome Powell will read the outcome. Many participants would pay attention to the Forex platform such as OlympTrade for a decisive direction.

Let’s dive into more recent events and significant chart levels.

EURO and US News

The European zones are positive that despite the COVID-19 crisis, they are coming out stronger. The banks’ result in Europe got the attention of investors and the share value of HSBC rose by 2.6%, while the collapse of the hedge fund (Archegos) affected the UBSG.

European unemployment Rate

This report shows the numbers of individuals who are actively seeking employment during the previous month. The outcome of the data is correlated to consumer spending because it accesses the economic health of the country with labor market condition.

The previous data was 8.3% and the forecast is 8.3% if the actual outcome is greater than the forecast it is not suitable for the currency while a lower data is good for the economy.

Traders’ and investors’ are expecting the FOMC outcome by Wednesday and it contains the outcome of their vote on interest rate increases or decrease or non-engrossment also including other policy measures including economic conditions influencing their decision and providing likely outcome.

Analysts expect the policy rate to remain unchanged when the chairperson Jerome Powell speaks.

The USD Advance GDP

This report surveys the changes in the value of goods and services that were produced within a certain period, and they release it after 30days at the end of a quarter. The report comes in 3 versions, the advance, preliminary and final. The version with the most impactful outcome is the advance version.

A data with higher outcome than the forecast is good for the currency, while a lower outcome is not suitable for the U.S. dollar. Previous data was 4.3% while the forecast is 6.5%.

EURUSD Technical Analysis

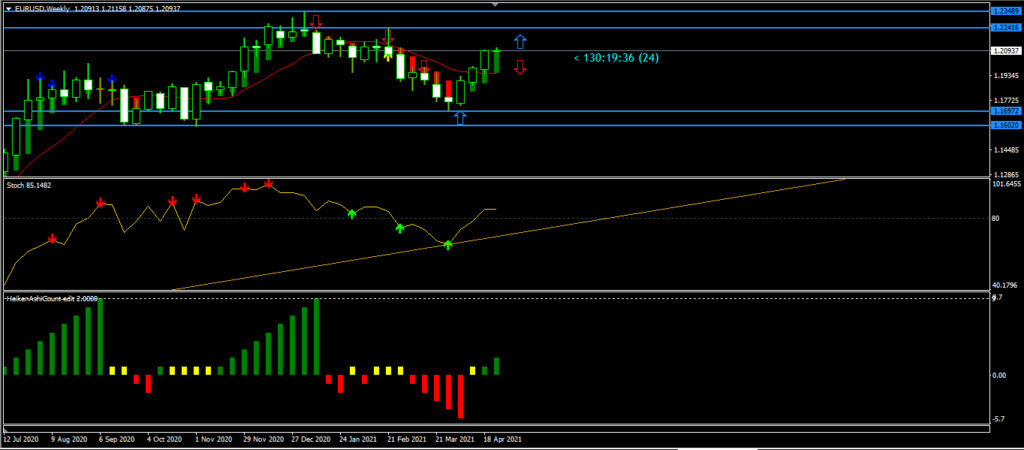

Weekly Chart Bullish Swing

Weekly Resistance Level: 1.23462

Weekly Support Level: 1.16770, 1.13970, 1.06263

The EURUSD pair is starting this week with a bullish bias after having a hard start during the first quarter of the year. The outcome of the Feds meeting will determine the direction of the US economy and it will interest the investors, traders and institutions to see how the market will react on the forex platform.

The bulls are pushing the EURUSD pair up despite the poor fundamentals that came out of the European news. We expect the price to test the resistance zone of February 1.23462 for either a breakout or we see rejections of candlesticks for a bearish trend in the following weeks.

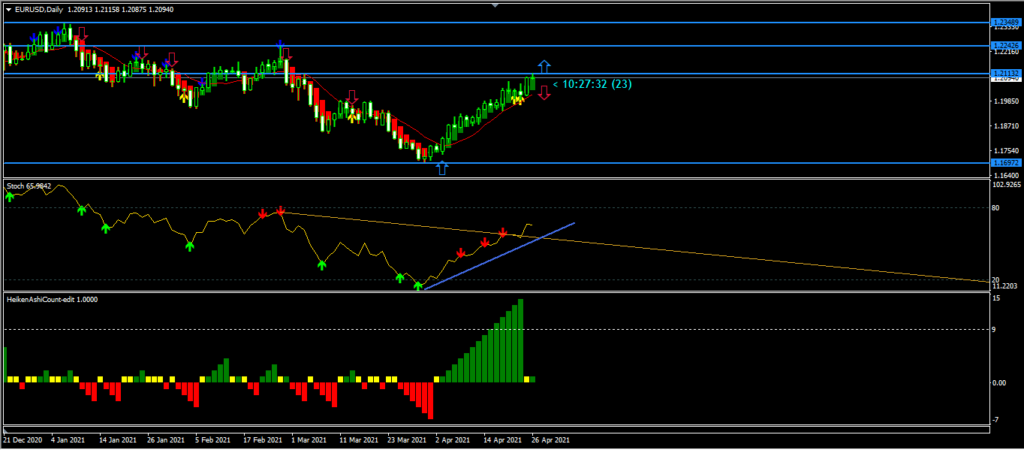

Daily Chart Projections: Bullish

Daily resistance levels 1.23489. 1.22426

Daily support levels 1.16972

The indicators on the forex platforms show that the bullish trend still has momentum to go high as we can see the candles are bigger and closing with little or no wicks as price approaches the resistance levels of 1.22426.

We cannot say the uptrend will continue forever until we see a reversal in trend, because of the Fed meeting outcome to be released this week, interested parties believes that the chairperson statement may still be dovish. However, a close above the resistance will mean a continuation of trend, but if the zone should reject the Bulls offers, we shall see a bearish trend from the zone.

H4 Intraday Chart Overview

Four Hour Resistance Levels 1.21159

Four Hour Support Levels 1.17440, 1.18596, 1.9929

On the four-hour time frame, we can see a clear bullish trend from the low of 1.17440 when the bullish divergences played out on the stochastic indicator. This move led the EURUSD pair to enjoy the uptrend on the chart.

The oscillator is showing that the price is in an overbought zone for a reversal. If the bears can take over the zones, we may see bearish candles pushing down the pair.

Conclusion and Weekly Price Objectives

The German business sectors had less than expected outcome as the third wave of COVID-19 continues to slow the recovery process because of inadequate supply of the vaccines and rapid rate of infections.

If the U.S. Federal Reserve should maintain a dovish sentiment, we may see the dollar weakened for the week.

No Comments found