USD/INR – Weekly Outlook for April 24 2019

USD/INR Outlook & Technical Analysis for Indian NIFTY 50

Introduction

Although the first quarter of 2019 started off by showing a retracement of the Indian Rupee gains, the exchange rate finally closed near Q1’s open. This showed that the bears are not ready to back down from their campaign towards a strong INR.

India’s Fundamentals

India’s Nifty 50 Index

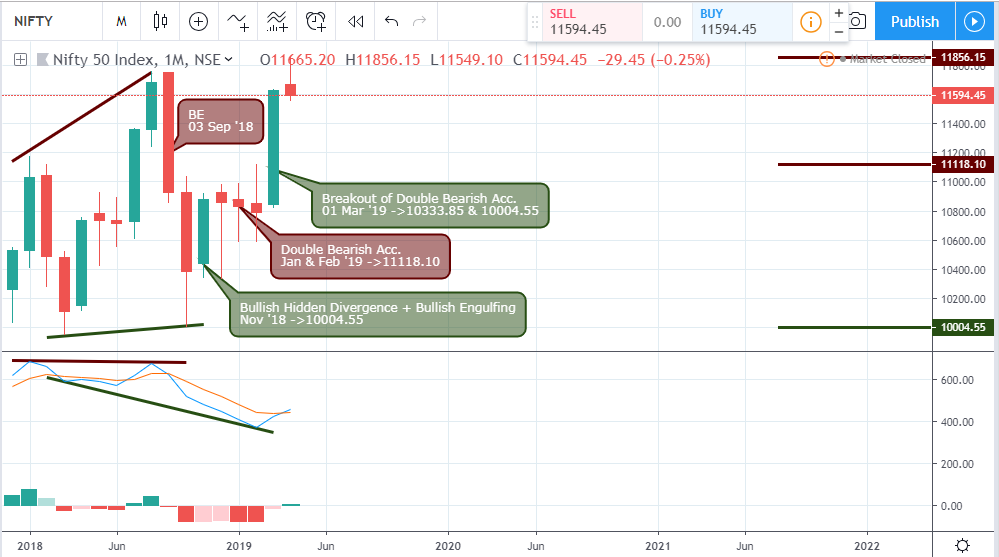

NIFTY 50 Index: Monthly Chart

India’s NIFTY 50 Index is enclosed in an expanding channel set up by bearish and bullish accumulation patterns on 03 Sep ’18 and November ’18. The bulls cracked through the bearish resistance of 11118.10 on 01 March ’19, confirmation of the bullish hidden divergence.

NIFTY 50 Index : Weekly Chart

Taking a step closer to the weekly chart, we notice how the price breaks out of a smaller channel triggered by a failure of bearish and bullish pressures to later hint on an opposing bearish regular divergence on April 22 ’19.

This generally indicates a strong Indian Rupee, however, the bearish regular divergence may lead to a bearish trend for the Rupee.

United States Fundamentals

Unemployment Claims

It is a weekly indicator that presents the value of continuing claims. Due to the difficult situation of the labor market, this indicator is increasingly becoming invaluable. A positive value is a negative sign for the economy.

Gross Domestic Product

Gross Domestic Product is the number of services and goods produced quarterly when summed up. The indicator, in this case, compared to the previous quarter indicates the growth of the GDP. This indicator is the most comprehensive indicator of the strength of the economy. A positive value or growth is good news for the currency.

Technical Analysis

USDINR Monthly Chart

Coming from a monthly chart perspective, the price of the Indian Rupee closed bearish in what appears to be a descending channel. The pair USD/INR currently trades above the opening price of March, indicating weakness of the Indian Rupee.

USDINR: Weekly Chart

Following a series of consecutive bearish closing candles, the weekly chart of the USD/INR enters into deep swings, forcing the price to oscillate within a declining channel as pointed out earlier on the monthly chart. Like a ping pong, the pair bounces from the lower trend line support on 26 November ’18 to 10 December ’18, all the way to 18 March ’19.

A more recently formed bearish accumulation resistance is threatened, indicating a possible bullish trend takeover.

USD/INR Daily Chart

Above, notice how the bears crashed through bullish pressure supports on 19 & 28 February ’19 setting up critical resistance at 71.624 and 71.510 as the price plummets by about 3.4%. After the price drop, the pair resumed a growing bullish trend signaled by bullish engulfing patterns on 19 March, 04 and 12 April respectively.

USDINR 4HR Chart

A view from the 4hour chart showed the pair breaking out of an equal triangle setup on 22 April ’19 01:00 with major support at 69.916. The patterns involved were bullish accumulation patterns on 03, 04 and 12 April ’19, followed by breakdown and bullish engulfing patterns on 09 and 11 April ’19.

USDINR 2HR Chart

On 18 and 21 April of the 2hour chart, a series of bullish hidden divergence reinforced the campaign to go long the USD/INR forcing the pair to shoot upward by 0.77%.

Conclusion and Projection

As an update to the monthly chart, we detect a quarterly bearish regular divergence pattern, indicating a longer-term price decline of the USD/INR confirming a stronger Indian Rupee.

The shorter daily, 4hour and 2hour charts will offer good swing trading opportunities in the bullish and bearish directions.

Check out the Olymp trade review section of our site to take advantage of their great trading platform as well as free demo account.

No Comments found